3 Black Crows Pattern

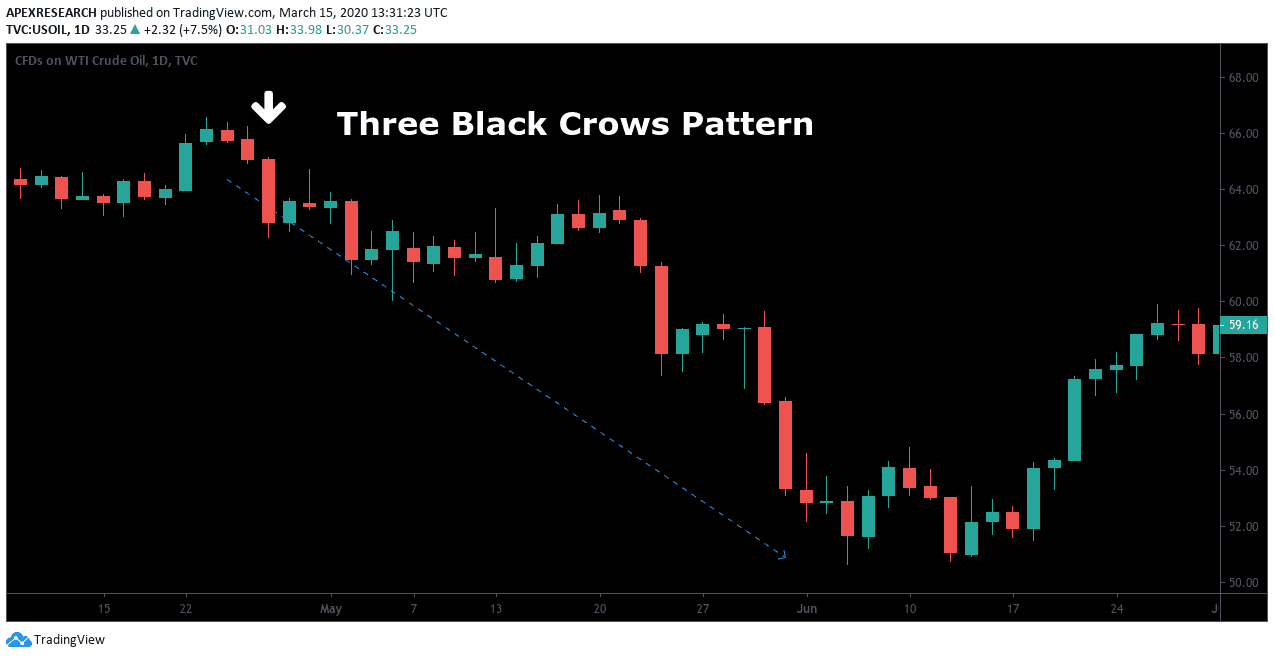

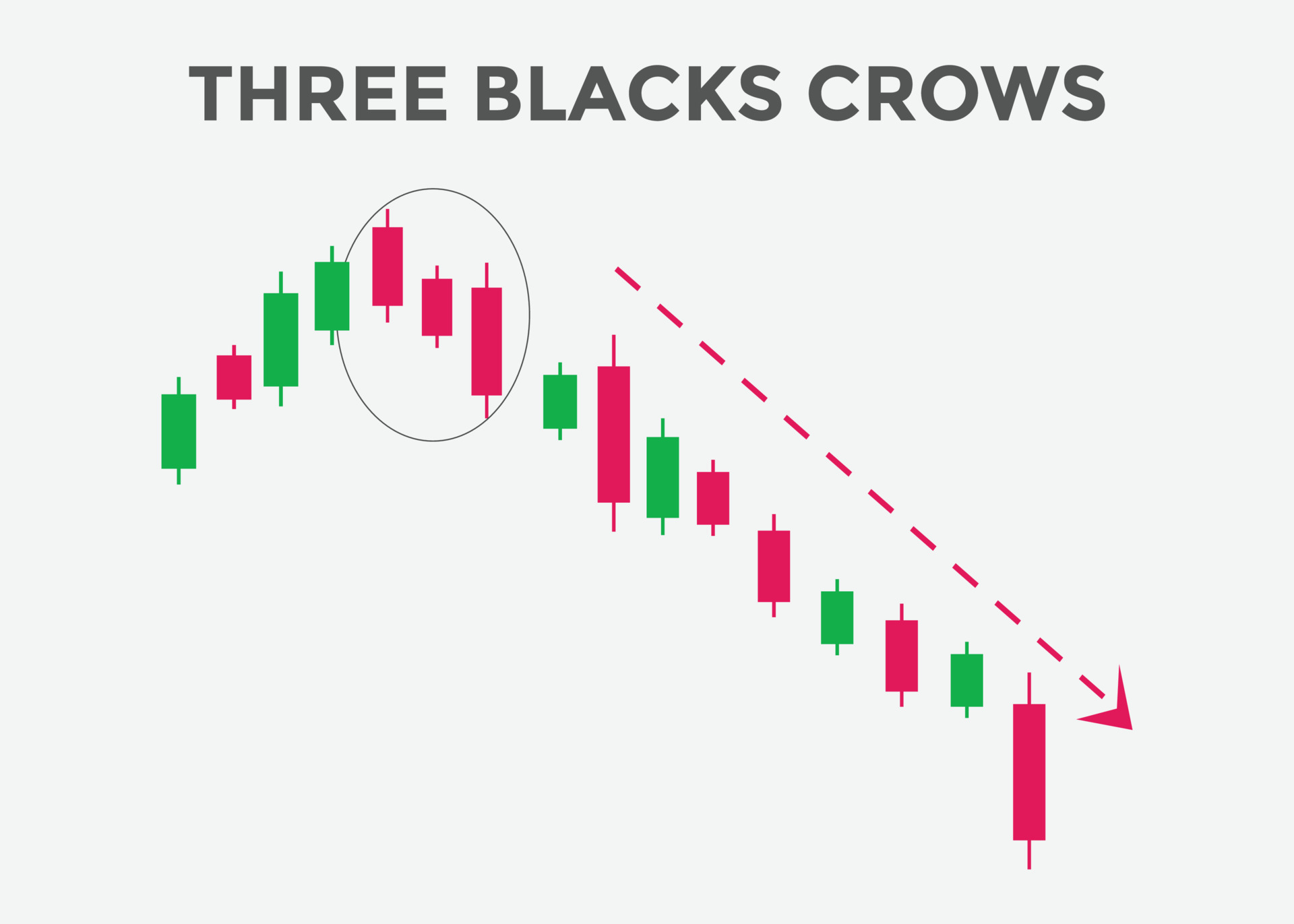

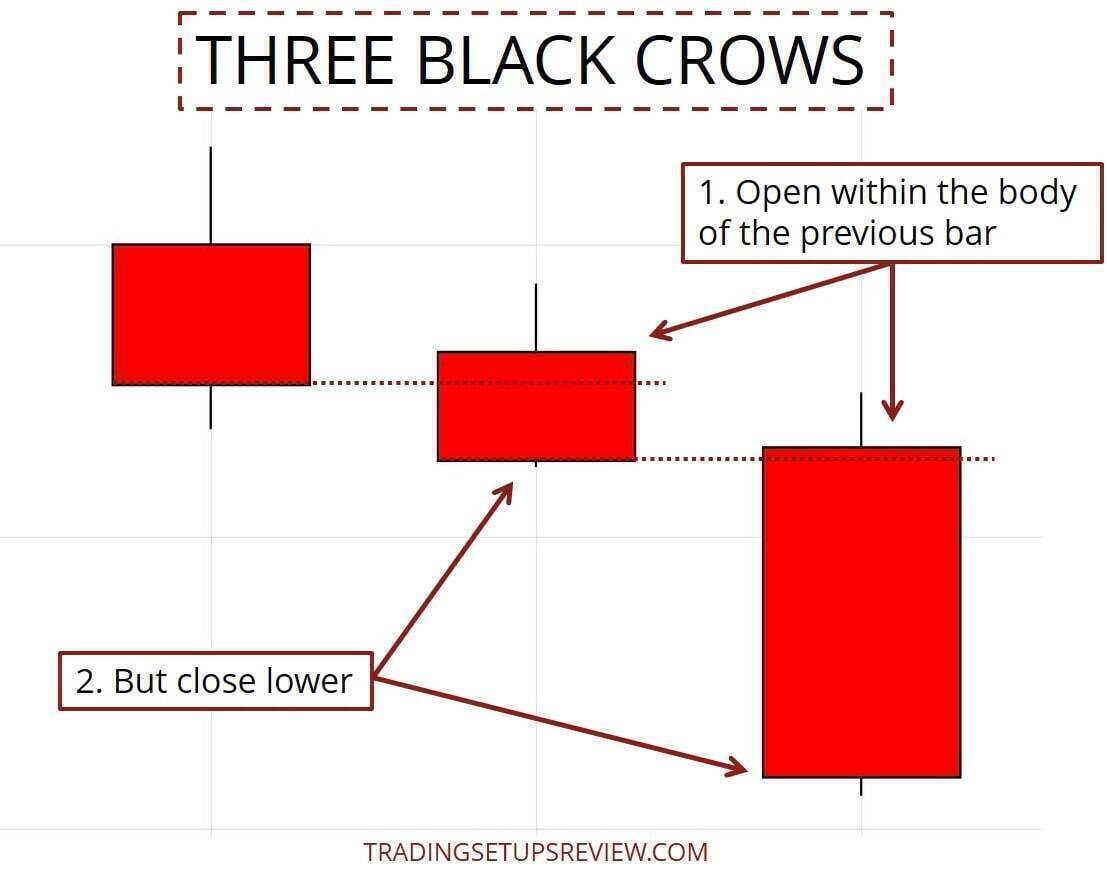

3 Black Crows Pattern - Web the three black crows pattern is a widely recognized bearish reversal pattern traders use to identify potential trend reversals. It unfolds across three trading sessions, and consists of three long candlesticks that trend downward like a staircase. This distinctive pattern can help traders identify areas of selling pressure and position themselves to profit from upcoming downward moves. But first, here’s how to recognize the three black crows pattern: Web three black crows is a bearish trend reversal candlestick pattern consisting of three candles. The pattern acts as a bearish reversal of the upward price. Web the three black crows pattern is a bearish candlestick pattern consisting of three consecutive bearish candlesticks that open near the previous day's close and close near their low. 3 consecutive candles with a lower close; It indicates a shift in market sentiment from bullish to bearish. Web three crows is a term used by stock market analysts to describe a market downturn. Each candlestick’s opening price should be lower than the previous candlestick’s opening price. Web the three black crows pattern is a famous candlestick formation that indicates a potential bearish reversal in the market trend. The pattern acts as a bearish reversal of the upward price. Three black crows may be commonly found in the cfd markets. The three black crows candlestick pattern is recognized if: By understanding the characteristics and limitations of this pattern, traders can make informed decisions and enhance their trading strategies. However, that’s the wrong way to look at it (and i’ll explain why shortly). Each candle's open price is within the previous candle's body; Web the 3 black crows pattern indicates a reversal or continuation. Web the three black crows pattern is a bearish candlestick pattern consisting of three consecutive bearish candlesticks that open near the previous day's close and close near their low. Web the three black crows pattern is a bearish reversal pattern consisting of three consecutive bearish long candlesticks that trend downward. Not any three black candles in a downward price trend will qualify. It unfolds across three trading sessions, and consists of three long candlesticks that trend downward like a staircase. Little to no lower wicks Each candle's open price. Web uncover the secrets of the three black crows pattern in 2024. This article explores the qualities of this pattern, interpretations, and trading strategies. Web learn the basics of the three black crows pattern and how analysts and traders interpret this bearish reversal pattern when creating a trading strategy. Each candle's open price is within the previous candle's body; Web. The presence of the 3 black crows often signals that a reversal is imminent as downward price movement shows no real resistance in the pattern. Appearing after the uptrend, all the three candles are long and bearish; Learn how it signals bearish trends and shapes trading strategies. However, that’s the wrong way to look at it (and i’ll explain why. This distinctive pattern can help traders identify areas of selling pressure and position themselves to profit from upcoming downward moves. This article explores the qualities of this pattern, interpretations, and trading strategies. Web how is the three black crows pattern interpreted? Web the 3 black crows pattern indicates a reversal or continuation. Web the three black crows pattern is a. It indicates a shift in market sentiment from bullish to bearish. Web uncover the secrets of the three black crows pattern in 2024. Learn how it signals bearish trends and shapes trading strategies. It appears on a candlestick chart in the financial markets. Web the three black crows candlestick is a pattern with definite identification rules or guidelines. Web three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend. Web the three black crows candlestick is a pattern with definite identification rules or guidelines. The three black crows candlestick pattern is recognized if: Little to no lower wicks It unfolds across three trading sessions, and consists of three long candlesticks that. Web you can find three black crows stock, commodity, and forex patterns. Web uncover the secrets of the three black crows pattern in 2024. Little to no lower wicks Web the three black crows pattern is a bearish reversal pattern that consists of three consecutive bearish long candlesticks that trend downward like a staircase. By understanding the characteristics and limitations. The pattern acts as a bearish reversal of the upward price. This fxopen article will help you understand how such a pattern is formed, demonstrating live trading examples and explaining how it can be used to. The three black crows candlestick pattern is recognized if: Web how is the three black crows pattern interpreted? Web the three black crows pattern. Appearing after the uptrend, all the three candles are long and bearish; The three black crows pattern generally represents an incoming downtrend. The three black crows is a bearish reversal pattern formed by three consecutive bearish candles after a bullish trend. Web the three black crows pattern is a famous bearish candlestick technical analysis indicator that signals the potential reversal. Web the three black crows candlestick is a pattern with definite identification rules or guidelines. It indicates a shift in market sentiment from bullish to bearish. Web the three black crows pattern is a bearish reversal pattern consisting of three consecutive bearish long candlesticks that trend downward. The pattern acts as a bearish reversal of the upward price. Web according. The three black crows pattern generally represents an incoming downtrend. Web you can find three black crows stock, commodity, and forex patterns. Little to no lower wicks It consists of three consecutive, relatively long bearish candlesticks that occur during an uptrend. It unfolds across three trading sessions, and consists of three long candlesticks that trend downward like a staircase. Three black crows occur after an uptrend and are characterized by a strong shift in market sentiment from bullish to bearish. These candles must open within the previous body or near the closing price. Each candlestick’s opening price should be lower than the previous candlestick’s opening price. Traders use it alongside other technical indicators such as the relative strength index. Web three black crows is a bearish trend reversal candlestick pattern consisting of three candles. This article explores the qualities of this pattern, interpretations, and trading strategies. The presence of the 3 black crows often signals that a reversal is imminent as downward price movement shows no real resistance in the pattern. Web according to most trading books, the three black crows is a bearish trend reversal candlestick pattern. Web the three black crows pattern is a bearish reversal pattern consisting of three consecutive bearish long candlesticks that trend downward. Appearing after the uptrend, all the three candles are long and bearish; Each candle's open price is within the previous candle's body;Three Black Crows Hit & Run Candlesticks

Three Black Crows Candlestick Pattern A Guide by Real Traders

How To Trade The Three Black Crows Pattern

Learn How To Trade With Three Black Crows Pattern

How To Trade Blog How To Use Three Black Crows Candlestick Pattern

How To Trade Blog How To Use Three Black Crows Candlestick Pattern

Three Black Crows candlestick pattern. Powerful bearish Candlestick

How To Trade The Three Black Crows Pattern

What Are Three Black Crows Candlestick Patterns Explained ELM

Three Black Crows Candlestick Pattern Trading Guide Trading Setups Review

3 Consecutive Candles With A Lower Close;

However, That’s The Wrong Way To Look At It (And I’ll Explain Why Shortly).

The Pattern Acts As A Bearish Reversal Of The Upward Price.

The Three Black Crows Is A Bearish Reversal Pattern Formed By Three Consecutive Bearish Candles After A Bullish Trend.

Related Post: