Bull Engulfing Pattern

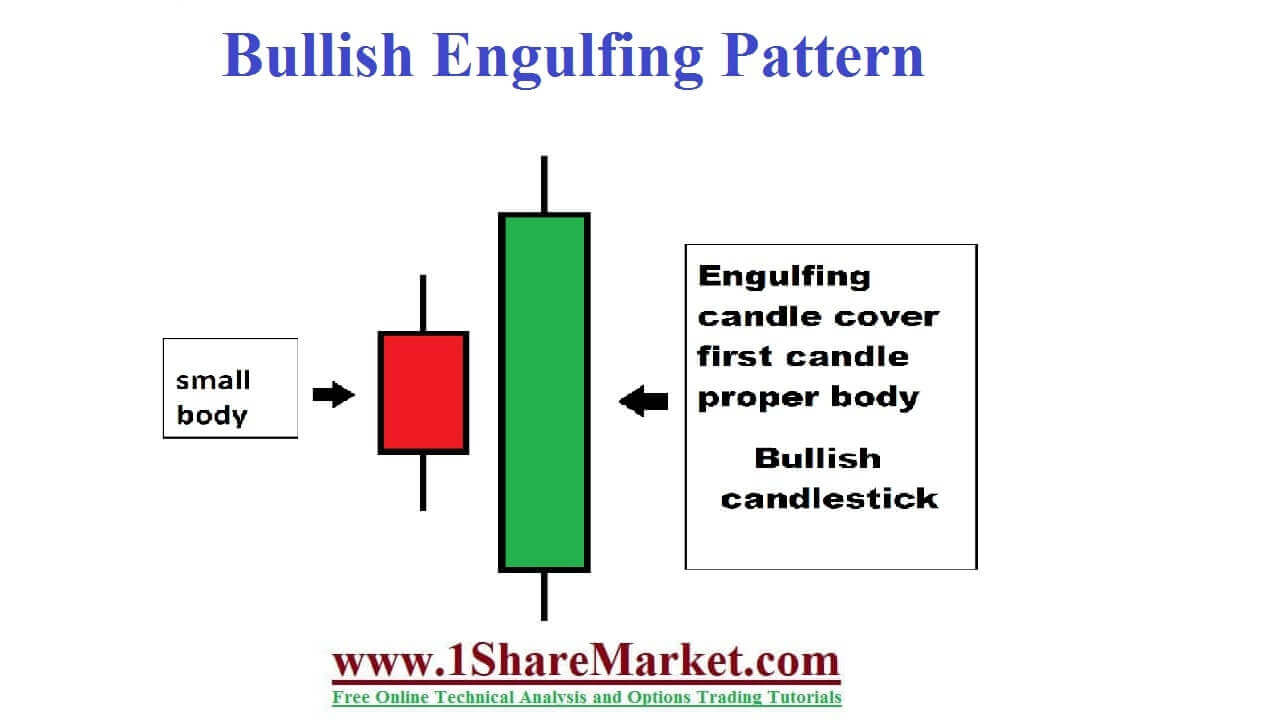

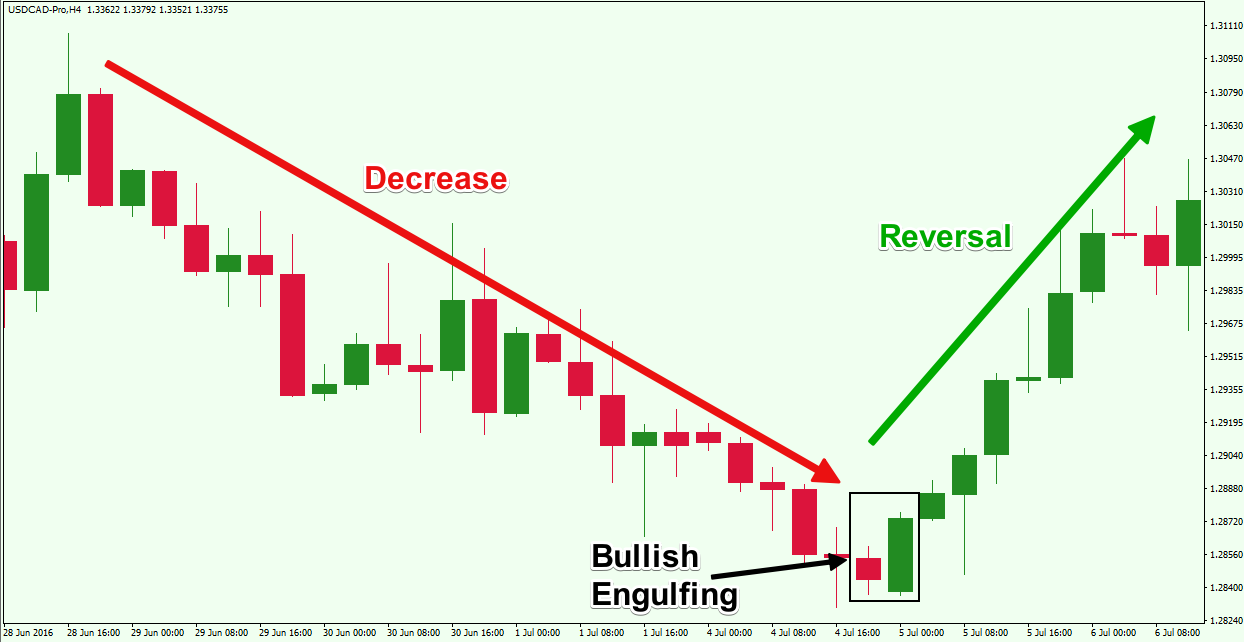

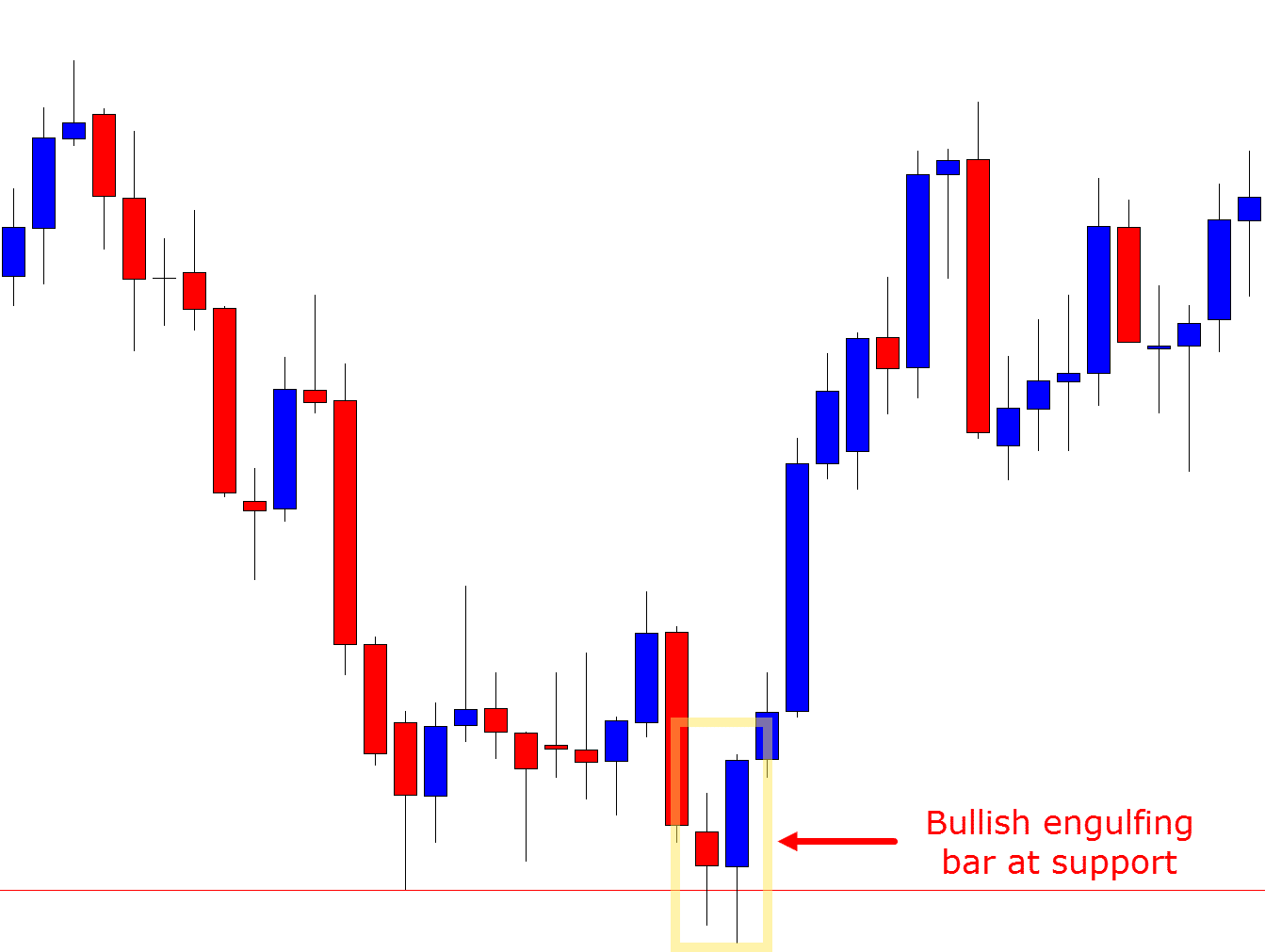

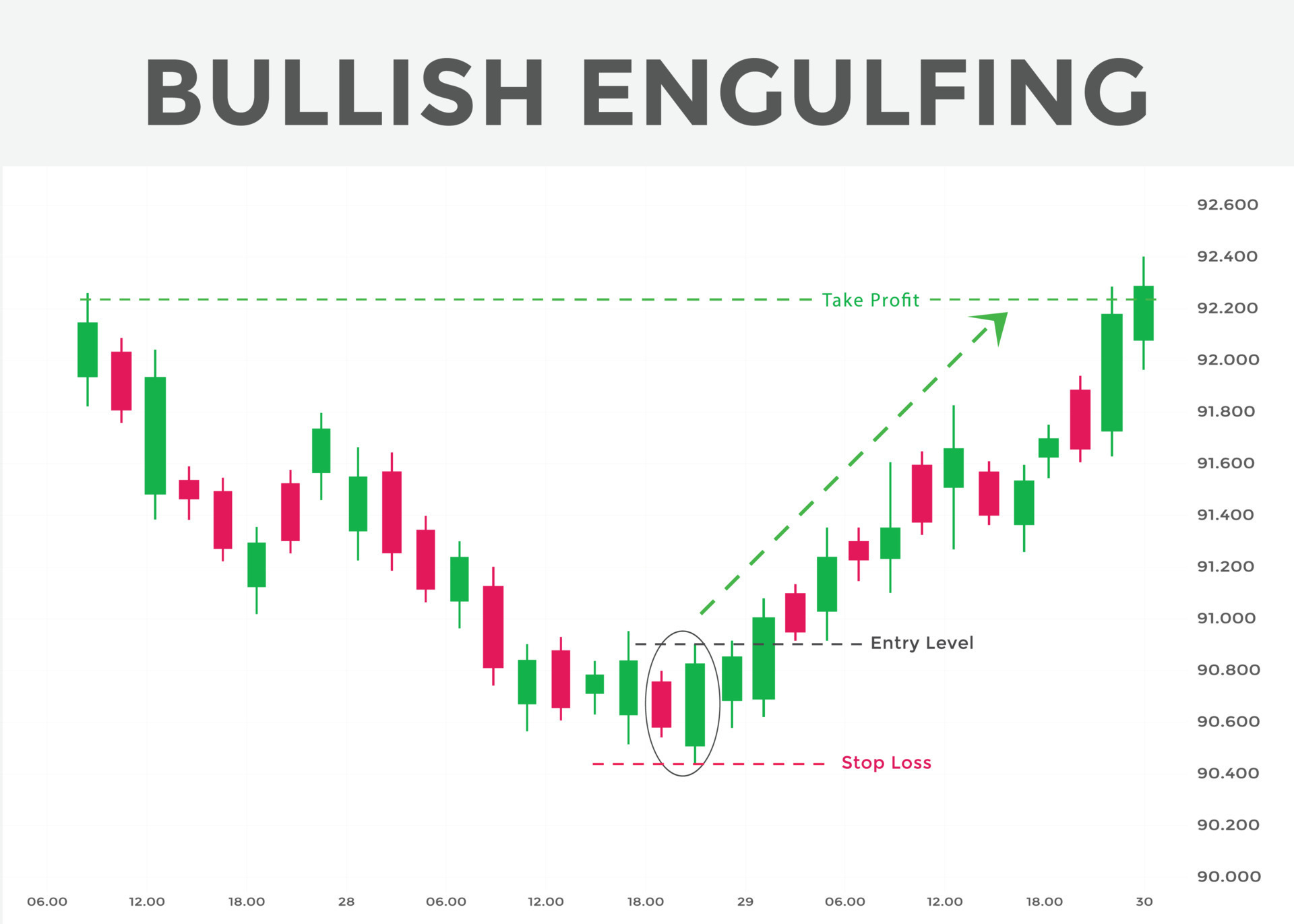

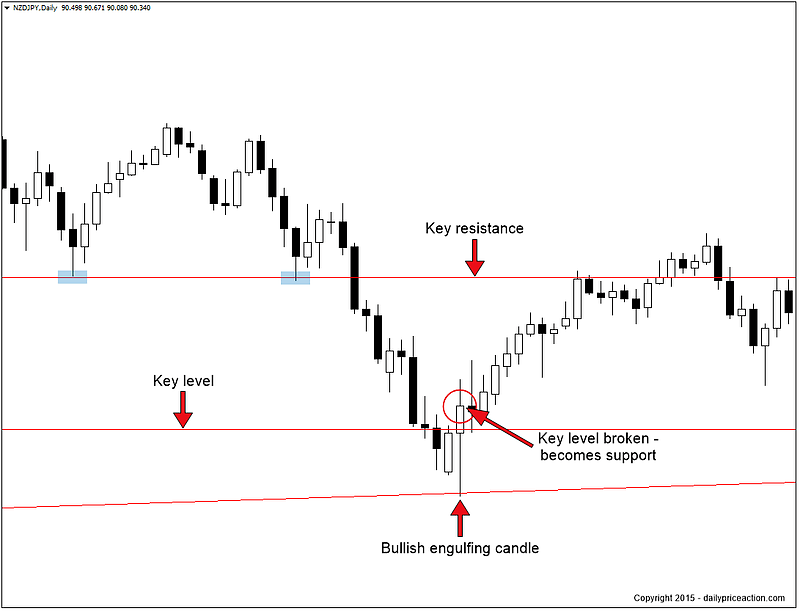

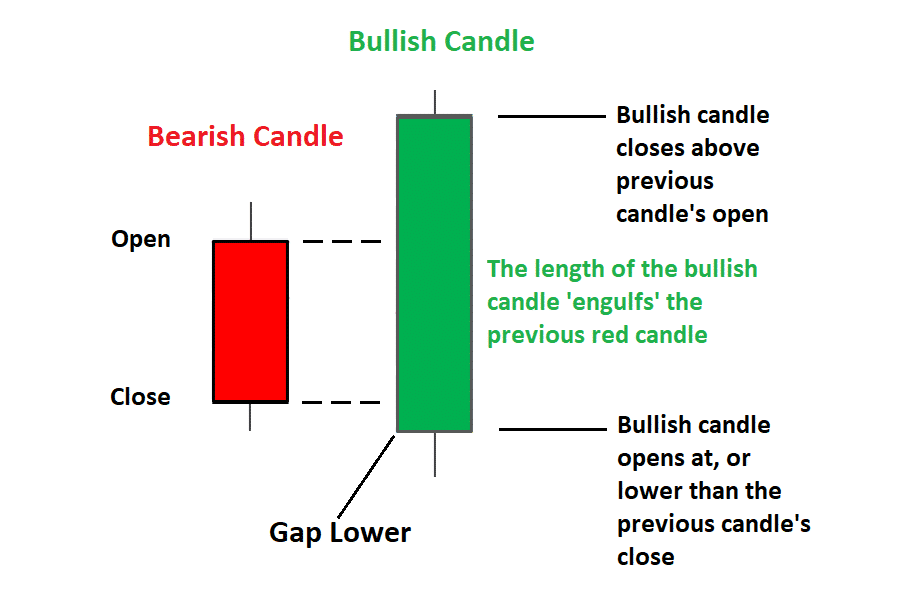

Bull Engulfing Pattern - While initially, the market is moving up, affirming bulls in control, the second candle implies a different thing. Typically, when the second smaller candle engulfs the first, the price fails and causes a bearish reversal. Engulfing patterns are made up of multiple candles, and are aptly named as one candle engulfs the previous candles. I have previously written about how to trade the bearish engulfing pattern, and as you might expect there are many similarities between the two. Here’s the idea behind it… Web the bullish engulfing pattern is a strong candlestick pattern that gives traders a practical tool for identifying future gains. Typically, when the 2nd smaller candle engulfs the first, the. How to identify a bullish engulfing pattern? Comprising two consecutive candles, the pattern features a smaller. Web the bullish engulfing candle appears at the bottom of a downtrend and indicates a surge in buying pressure. Web understanding the bullish engulfing pattern means diving into the details of price action, recognizing support and resistance levels, and knowing how to trade it. Web the bullish engulfing pattern is a strong candlestick pattern that gives traders a practical tool for identifying future gains. Comprising two consecutive candles, the pattern features a smaller. The bullish engulfing pattern often triggers a reversal in trend as more buyers enter. The pattern consists of a smaller bearish candle followed by a larger bullish candle that 'engulfs' the previous candle. The bullish engulfing pattern appears in a downtrend and is a combination of one dark candle followed by a larger hollow. With a bullish trend in the macd, signal lines, and 50d ema, the meme coin approaches the 2.618% fib level. Web the bullish engulfing candlestick pattern is a bullish reversal pattern, usually occurring at the bottom of a downtrend. The prerequisites for the pattern are as follows: Web a bullish engulfing pattern is a type of price chart pattern that indicates a bullish reversal in a security’s price performance. The bearish engulfing pattern signals the possible end of a bullish trend. There are bullish and bearish equivalents to this pattern. This article will take you on a journey through this pattern and teach you how to leverage it in your trading strategy. A bullish candle engulfs the body of the previous bearish candle: This move negates previous indecision patterns. It gets its name from the second candle that engulfs the first candle in the bullish direction. Web bullish and bearish engulfing candlestick patterns are powerful reversal formations that generate a signal of a potential reversal. Web definition of the bullish engulfing candlestick pattern. Web the bearish engulfing pattern implies an unexpected change of sentiment in the market. Web the. The bearish engulfing pattern signals the possible end of a bullish trend. Web a bearish engulfing pattern consists of two candlesticks that form near resistance levels where the second bearish candle engulfs the smaller first bullish candle. Currently, the mog price trades at $0.0000021 and an intraday pullback of 3.15%. Web the bearish engulfing pattern implies an unexpected change of. Web a bullish engulfing pattern is a candlestick pattern that forms when a small black candlestick is followed the next day by a large white candlestick, the body of which completely overlaps or. Web the nifty50 has formed a bullish engulfing pattern on the daily chart, overtaking the doji candlestick patterns of the previous two sessions. With a bullish trend. Here’s the idea behind it… Typically, when the second smaller candle engulfs the first, the price fails and causes a bearish reversal. This quick introduction will teach you how to identify the pattern, and how traders use this in technical analysis. This pattern implies that buyers have complete control in the market overpowering the sellers. As similar as they may. Web the bullish engulfing pattern is a two candlestick pattern which appears at the bottom of the downtrend. The pattern consists of a smaller bearish candle followed by a larger bullish candle that 'engulfs' the previous candle. They are popular candlestick patterns because they are easy to spot and trade. Web bullish and bearish engulfing candlestick patterns are powerful reversal. This technical pattern is considered bullish, suggesting that the stock may experience a. Web bullish and bearish engulfing candlestick patterns are powerful reversal formations that generate a signal of a potential reversal. This pattern implies that buyers have complete control in the market overpowering the sellers. The prior trend should be a downtrend. The bullish engulfing pattern often triggers a. With a bullish trend in the macd, signal lines, and 50d ema, the meme coin approaches the 2.618% fib level. Web bullish engulfing pattern. Typically, when the 2nd smaller candle engulfs the first, the. Web the bullish engulfing pattern is a strong candlestick pattern that gives traders a practical tool for identifying future gains. How to identify a bullish engulfing. Web the bearish engulfing pattern implies an unexpected change of sentiment in the market. This article will take you on a journey through this pattern and teach you how to leverage it in your trading strategy. The bullish engulfing pattern appears in a downtrend and is a combination of one dark candle followed by a larger hollow. Web the bullish. They are popular candlestick patterns because they are easy to spot and trade. A bullish candle engulfs the body of the previous bearish candle: Web the bullish engulfing pattern is a strong candlestick pattern that gives traders a practical tool for identifying future gains. Web the bearish engulfing pattern implies an unexpected change of sentiment in the market. Web in. Web bullish engulfing pattern. Web a bullish engulfing pattern consists of two candlesticks that form near support levels; They are popular candlestick patterns because they are easy to spot and trade. Web the bullish engulfing pattern provides the strongest signal when appearing at the bottom of a downtrend and indicates a surge in buying pressure. Web the bullish engulfing pattern is a strong candlestick pattern that gives traders a practical tool for identifying future gains. This article will take you on a journey through this pattern and teach you how to leverage it in your trading strategy. There are bullish and bearish equivalents to this pattern. Web understanding the bullish engulfing pattern means diving into the details of price action, recognizing support and resistance levels, and knowing how to trade it. A bullish candle engulfs the body of the previous bearish candle: Web the bearish engulfing pattern implies an unexpected change of sentiment in the market. Web the bullish engulfing candle appears at the bottom of a downtrend and indicates a surge in buying pressure. The bearish engulfing pattern signals the possible end of a bullish trend. The bullish engulfing pattern often triggers a reversal in trend as more buyers enter. It gets its name from the second candle that engulfs the first candle in the bullish direction. As long as the index remains above this level, the trend may remain positive. Web how to use the bullish engulfing pattern to catch market bottoms with precision.What are Bullish Candlestick Patterns?

Trading the Bullish Engulfing Candle

best candlestick patterns for forex, stock, cryptocurrency trades

Bullish Engulfing Pattern The Ultimate Guide Daily Price Action

Bullish Engulfing Pattern An Important Technical Pattern

Bullish Engulfing Pattern Definition, Example, and What It Means

Bullish engulfing pattern bullish engulfing candlestick pattern

Bullish Engulfing Pattern What is it? How to use it?

Bullish and Bearish Engulfing Candlesticks ThinkMarkets UK

bullishengulfingreversalpattern Forex Training Group

The Prior Trend Should Be A Downtrend.

Web The Bullish Engulfing Pattern Is One Of My Favorite Reversal Patterns In The Forex Market.

The Pattern Consists Of A Smaller Bearish Candle Followed By A Larger Bullish Candle That 'Engulfs' The Previous Candle.

Comprising Two Consecutive Candles, The Pattern Features A Smaller.

Related Post:

:max_bytes(150000):strip_icc()/BullishEngulfingPatternDefinition2-5f046aee5fe24520bfd4e6ad8abaeb74.png)