Bullish Candlestick Patterns

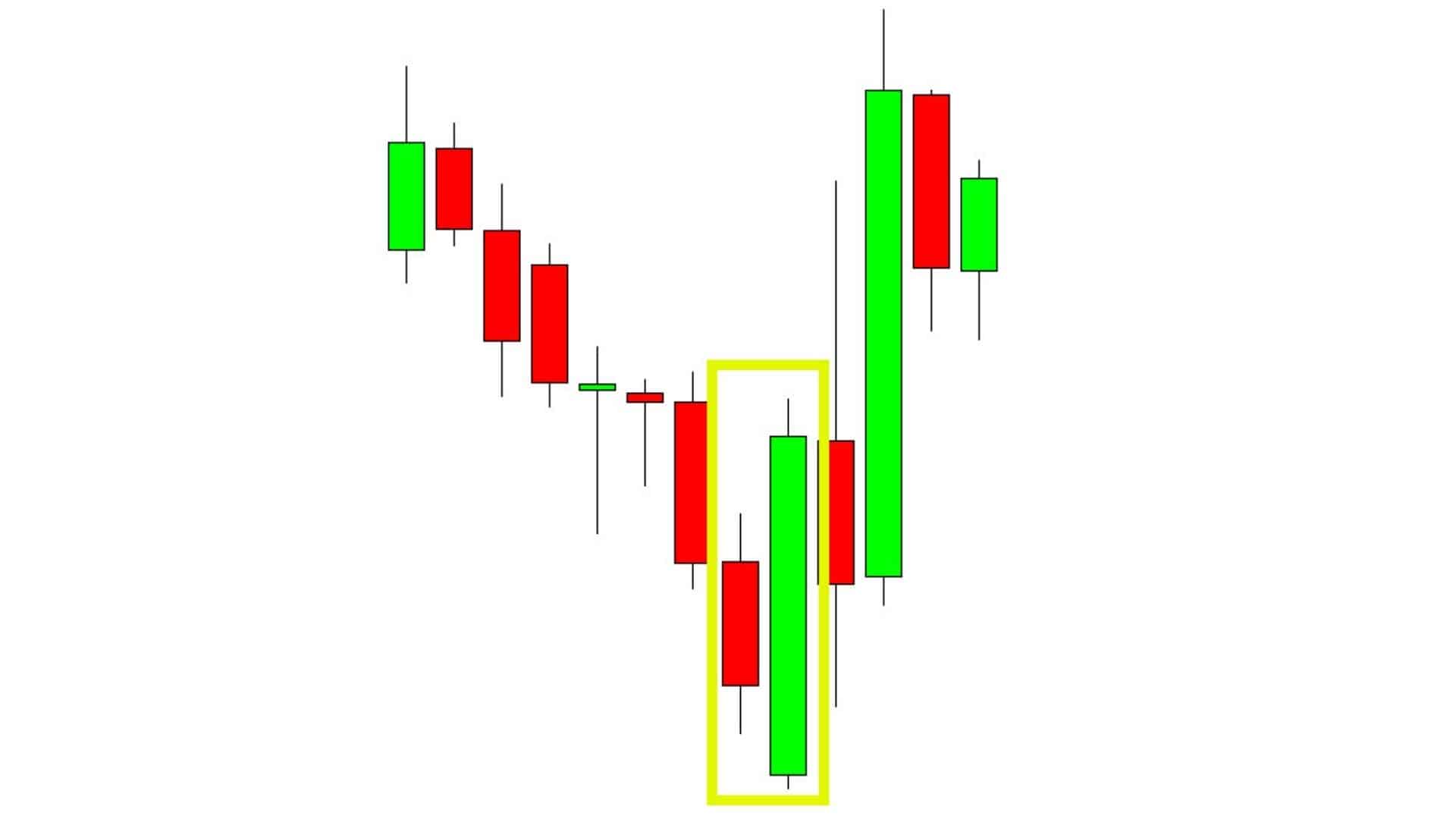

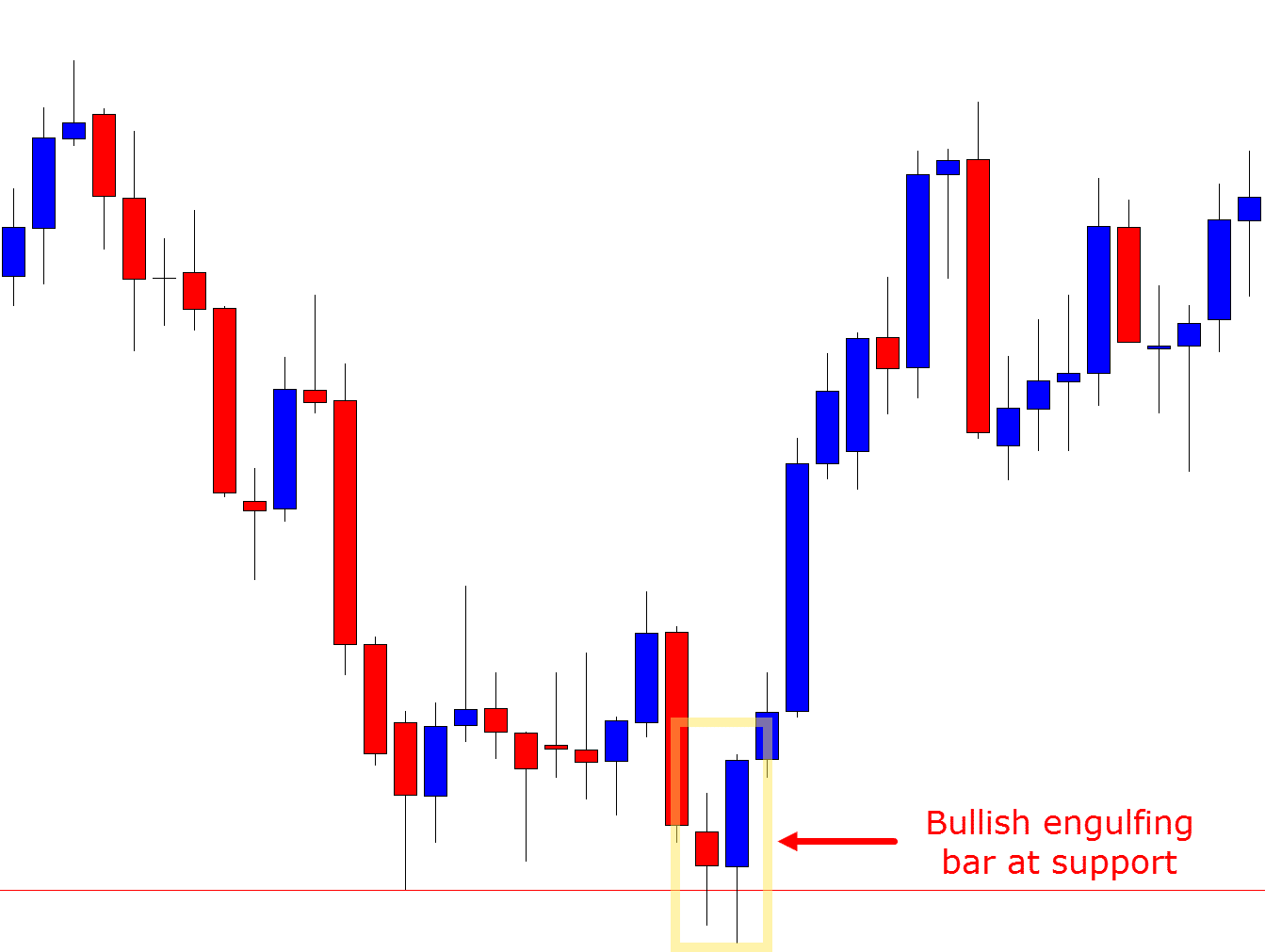

Bullish Candlestick Patterns - Bullish, bearish, reversal, continuation and indecision with examples and explanation. How to read a single candlestick. What do 3 green candles mean? There are dozens of different candlestick patterns. Web candlestick patterns are technical trading tools that have been used for centuries to predict price direction. Here are some of the most popular bullish candlestick. We provide a list of bullish signals to help you make informed trading decisions. Web the bullish candlestick patterns consist of one or two candlesticks, which means there can be single or multiple candlesticks. Each candlestick represents one day’s. Web bullish patterns comprise two to three candlesticks that form breakout patterns and trendlines. Web candlestick patterns are made up of individual “candles,” each showing the price movement for a certain time period. How to read a single candlestick. In this guide, you will learn how to use candlestick patterns to make your investment decisions. Here are some of the most popular bullish candlestick. Web looking to gain a better understanding of bullish candlestick patterns? Web a bullish candle pattern informs traders that the market is about to enter an uptrend after a previous decrease in prices. What are some examples of bullish candles?. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. Web a daily candlestick close below $0.0151 would invalidate the bullish thesis. This is painting a broad stroke, because the context of the candle formation. In this guide, you will learn how to use candlestick patterns to make your investment decisions. Bullish, bearish, reversal, continuation and indecision with examples and explanation. Understand their significance in technical analysis, including the bullish engulfing. Web there are three types of candlestick interpretations: Web learn about all the trading candlestick patterns that exist: Web bullish candlestick patterns might signal a potential reversal when the market is in a downtrend. How to read a single candlestick. Web a daily candlestick close below $0.0151 would invalidate the bullish thesis. Web six bullish candlestick patterns. Each candlestick represents one day’s. There are many bullish candlestick. Let’s break down the basics: What are some examples of bullish candles?. Web a daily candlestick close below $0.0151 would invalidate the bullish thesis. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. Web updated february 28, 2024. What do 3 green candles mean? Web learn about bullish candlestick patterns in this beginner's guide. Web there are three types of candlestick interpretations: Here are some of the most popular bullish candlestick. For example, identifying a bullish candlestick pattern. Web whether it's a long white candle, bullish hammer candlestick, morning star, or doji candlestick pattern, learning to recognize these bullish candlesticks will add a. Web candlestick patterns are technical trading tools that have been used for centuries to predict price direction. Web looking to gain a better understanding of bullish candlestick patterns?. Web bullish patterns comprise two to three candlesticks that form breakout patterns and trendlines. For example, identifying a bullish candlestick pattern. This is painting a broad stroke, because the context of the candle formation. Come find out how to properly use these patterns to day trade! Bullish, bearish, reversal, continuation and indecision with examples and explanation. Fact checked by kirsten rohrs schmitt. Bearish candlestick patterns might signal a possible reversal. How to read a single candlestick. What do 3 green candles mean? Web a daily candlestick close below $0.0151 would invalidate the bullish thesis. Web bullish patterns comprise two to three candlesticks that form breakout patterns and trendlines. Web bullish candlestick patterns suggest that the buyers (bulls) are in charge and that price will move higher. Web there are three types of candlestick interpretations: That’s why in today’s guide… we will focus on practical implications on how you can use bullish candlestick patterns to. Web candlestick patterns are made up of individual “candles,” each showing the price movement for a certain time period. There are many bullish candlestick. What do 3 green candles mean? Bearish candlestick patterns might signal a possible reversal. Bullish, bearish, reversal, continuation and indecision with examples and explanation. In this guide, you will learn how to use candlestick patterns to make your investment decisions. Web a bullish candle pattern informs traders that the market is about to enter an uptrend after a previous decrease in prices. This reversal pattern is a signal that bulls are taking over. Web there are certain bullish patterns, such as the bull flag. There are many bullish candlestick. Web a bullish candlestick pattern is a particular placement of two or more candlesticks on the chart that indicates a breakout or a sustained move to the upside. Web bullish candlestick patterns are a sign of the end of a downtrend. Learn how these patterns work and which 8 ones you should know. This is painting a broad stroke, because the context of the candle formation. Web whether it's a long white candle, bullish hammer candlestick, morning star, or doji candlestick pattern, learning to recognize these bullish candlesticks will add a. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. Fact checked by kirsten rohrs schmitt. Candlestick trading is a form of technical. They are an indicator for traders to consider. Here are some of the most popular bullish candlestick. In this guide, you will learn how to use candlestick patterns to make your investment decisions. Web a bullish candle pattern informs traders that the market is about to enter an uptrend after a previous decrease in prices. Web using candlestick patterns with key areas of value—such as support and resistance levels, trendlines,. Web bullish patterns comprise two to three candlesticks that form breakout patterns and trendlines. Web what are bullish candlestick reversal patterns?Bullish Candlestick Patterns Pdf Candle Stick Trading Pattern

Bullish Candlestick Patterns PDF Guide Free Download

6 Reliable Bullish Candlestick Pattern TradingSim

Bullish Candlestick Patterns Free PDF Download Advanced Forex

Candlestick Patterns The Definitive Guide (2021)

What are Bullish Candlestick Patterns?

Bullish candlestick patterns📚 . Technical analysis Don’t to

Bullish Candlestick Patterns Pdf Candle Stick Trading Pattern

Candlestick Patterns The Definitive Guide (2021)

Candlestick Patterns The Definitive Guide (2021)

How To Read A Single Candlestick.

Web The Bullish Candlestick Patterns Consist Of One Or Two Candlesticks, Which Means There Can Be Single Or Multiple Candlesticks.

Web Looking To Gain A Better Understanding Of Bullish Candlestick Patterns?

On July 18, 3 Stocks From The Nifty500 Pack Came To The Bullish Scanner Of White Marubozu, According To Stockedge.com's Technical Scan.

Related Post: