Bullish Reversal Candlestick Patterns

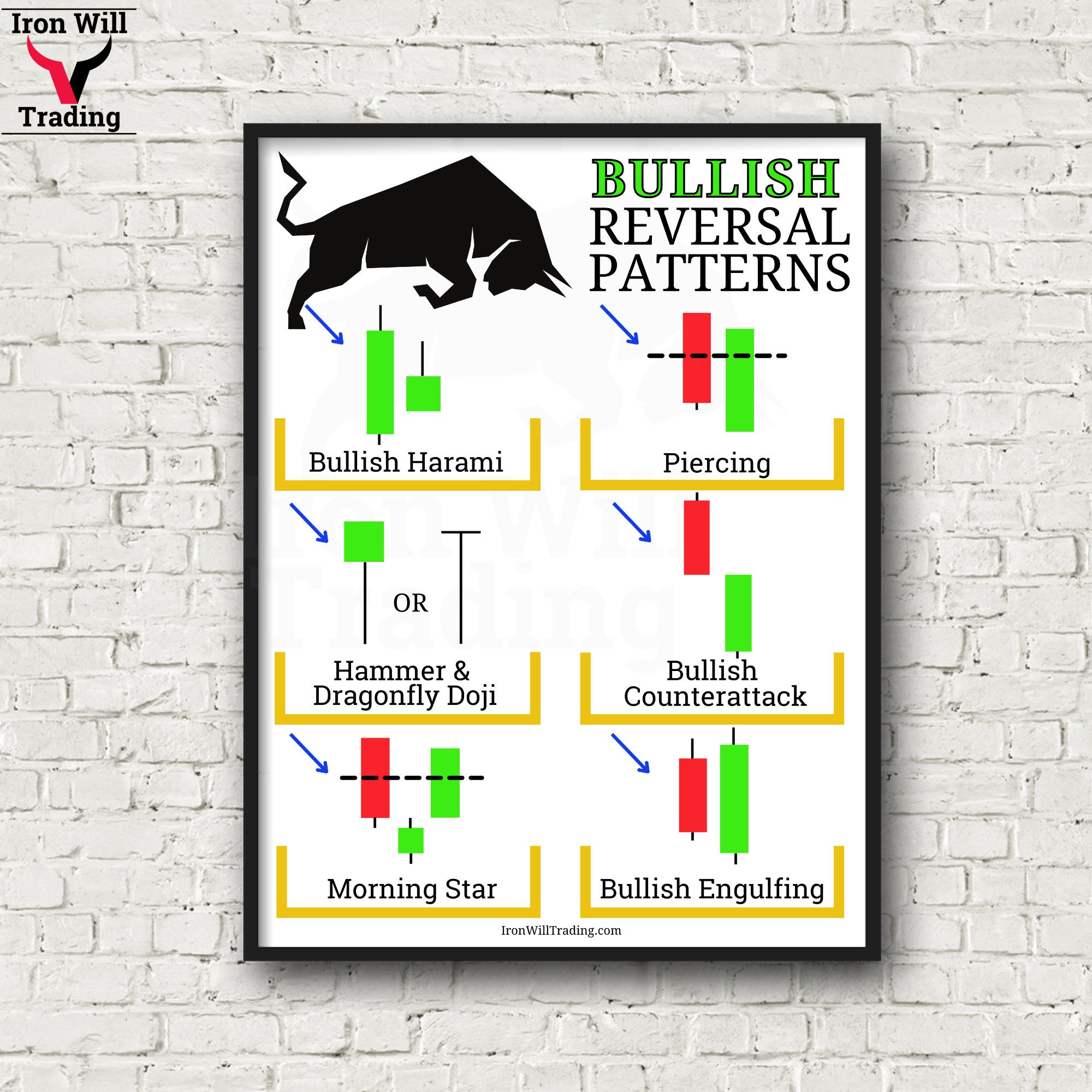

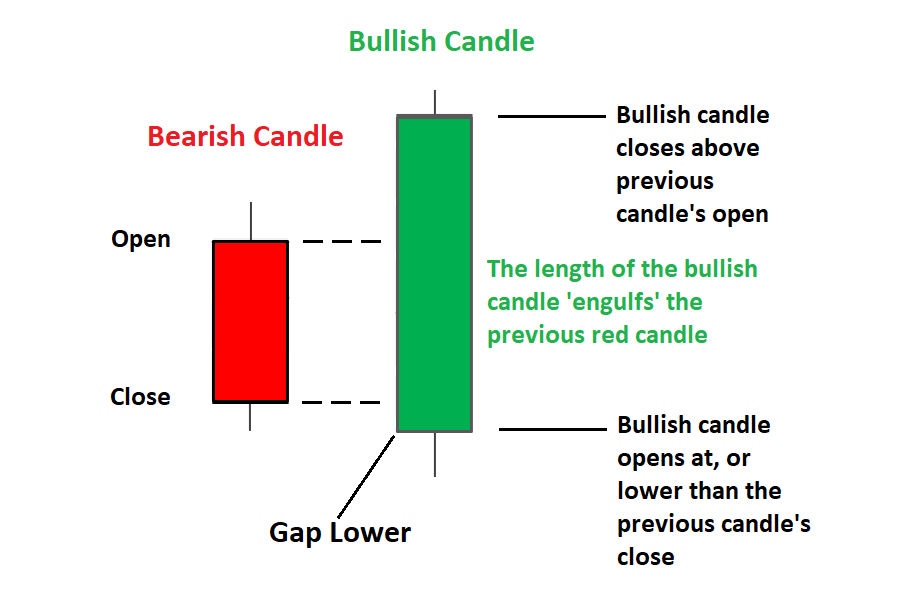

Bullish Reversal Candlestick Patterns - Web what is a bullish reversal candlestick pattern? It also indicates where buyers were able to overcome selling pressure. Web find out how bullish and bearish reversal candlestick patterns show that the market is reversing. Bullish japanese candlestick reversal patterns are displayed below from strongest to weakest. The bullish reversal identifies a possible end to a bearish trend. Get a definition, signals of an uptrend, and downtrend on real charts. For this article, i am going to share 25 bullish. On the contrary, that may signal that the stock is nearing a bottom in a downtrend. Web a pattern like a hammer candlestick is a bullish reversal pattern, potentially ending a downtrend. Some examples of bullish candles are the hammer, inverted hammer, and bullish engulfing patterns. Some examples of bullish candles are the hammer, inverted hammer, and bullish engulfing patterns. The bullish reversal identifies a possible end to a bearish trend. It also indicates where buyers were able to overcome selling pressure. Web bullish reversal candlestick patterns. Reversals are patterns that tend to resolve in the opposite direction to the prevailing trend: For this article, i am going to share 25 bullish. Web find out how bullish and bearish reversal candlestick patterns show that the market is reversing. These patterns are shifts in bullish sentiment to predict a possible uptrend in price movement. Web what is a bullish reversal candlestick pattern? This shows buying pressure stepped in and reversed the downtrend. Let's examine some of the most common bullish reversal candlestick patterns next. The bullish reversal identifies a possible end to a bearish trend. Web when viewed together over a period of time, these candlesticks form patterns that traders analyze to gauge trend reversal points, momentum, and potential future price direction. Web what is a bullish reversal candlestick pattern? Web bullish. The bullish reversal identifies a possible end to a bearish trend. On the contrary, that may signal that the stock is nearing a bottom in a downtrend. These patterns are shifts in bullish sentiment to predict a possible uptrend in price movement. Web there are a number of candlestick patterns used by technical traders to spot bullish reversal, bearish reversal,. Some examples of bullish candles are the hammer, inverted hammer, and bullish engulfing patterns. Web bullish reversal candlestick patterns are graphic representations of price movements in trading that suggest a potential reversal of a downward trend, indicating that the price of a security may begin to rise. Let's examine some of the most common bullish reversal candlestick patterns next. A. Web bullish candlestick reversal patterns contain the open price at the low of the period and close near the high. Web bullish reversal candlestick patterns. For this article, i am going to share 25 bullish. Web what is a bullish reversal candlestick pattern? Reversals are patterns that tend to resolve in the opposite direction to the prevailing trend: Bullish japanese candlestick reversal patterns are displayed below from strongest to weakest. It also indicates where buyers were able to overcome selling pressure. Reversals are patterns that tend to resolve in the opposite direction to the prevailing trend: For this article, i am going to share 25 bullish. The bullish reversal identifies a possible end to a bearish trend. For this article, i am going to share 25 bullish. It also indicates where buyers were able to overcome selling pressure. This shows buying pressure stepped in and reversed the downtrend. Web a pattern like a hammer candlestick is a bullish reversal pattern, potentially ending a downtrend. Bullish japanese candlestick reversal patterns are displayed below from strongest to weakest. Let's examine some of the most common bullish reversal candlestick patterns next. For this article, i am going to share 25 bullish. This shows buying pressure stepped in and reversed the downtrend. Some examples of bullish candles are the hammer, inverted hammer, and bullish engulfing patterns. Web when viewed together over a period of time, these candlesticks form patterns that. Some examples of bullish candles are the hammer, inverted hammer, and bullish engulfing patterns. Let's examine some of the most common bullish reversal candlestick patterns next. Web bullish reversal candlestick patterns. The bullish reversal identifies a possible end to a bearish trend. A reversal pattern must be validated by continuation and an. Web a pattern like a hammer candlestick is a bullish reversal pattern, potentially ending a downtrend. On the contrary, that may signal that the stock is nearing a bottom in a downtrend. These patterns are shifts in bullish sentiment to predict a possible uptrend in price movement. Some examples of bullish candles are the hammer, inverted hammer, and bullish engulfing. A reversal pattern must be validated by continuation and an. Some examples of bullish candles are the hammer, inverted hammer, and bullish engulfing patterns. On the contrary, that may signal that the stock is nearing a bottom in a downtrend. This shows buying pressure stepped in and reversed the downtrend. For this article, i am going to share 25 bullish. Web there are a number of candlestick patterns used by technical traders to spot bullish reversal, bearish reversal, or continuation patterns. It also indicates where buyers were able to overcome selling pressure. A reversal pattern must be validated by continuation and an. On the contrary, that may signal that the stock is nearing a bottom in a downtrend. Web when viewed together over a period of time, these candlesticks form patterns that traders analyze to gauge trend reversal points, momentum, and potential future price direction. Reversals are patterns that tend to resolve in the opposite direction to the prevailing trend: Web there are a great many candlestick patterns that indicate an opportunity to buy. Web bullish reversal candlestick patterns. Web what is a bullish reversal candlestick pattern? Web bullish reversal candlestick patterns are graphic representations of price movements in trading that suggest a potential reversal of a downward trend, indicating that the price of a security may begin to rise. Web bullish candlestick reversal patterns contain the open price at the low of the period and close near the high. Let's examine some of the most common bullish reversal candlestick patterns next. Bullish japanese candlestick reversal patterns are displayed below from strongest to weakest. Get a definition, signals of an uptrend, and downtrend on real charts. For this article, i am going to share 25 bullish. This shows buying pressure stepped in and reversed the downtrend.Advanced Candlestick Patterns

Bullish Candlestick Reversal Patterns Cheat Sheet in 2020 Trading

Bullish Reversal Candlestick Patterns Day Trading Poster Investing

Candlestick Patterns Cheat sheet r/CryptoMarkets

Bullish candlestick patterns📚 . Technical analysis Don’t to

Bullish Breakaway Candlestick Pattern Candle Stick Trading Pattern

Technical Analysis Candlestick Pattern

Forex Candlestick Patterns Fast Scalping Forex Hedge Fund

bullishreversalcandlestickpatternsforexsignals daytrading

Bullish Candlestick Patterns Pdf Candle Stick Trading Pattern

Web A Pattern Like A Hammer Candlestick Is A Bullish Reversal Pattern, Potentially Ending A Downtrend.

Web Find Out How Bullish And Bearish Reversal Candlestick Patterns Show That The Market Is Reversing.

We Will Focus On Five Bullish Candlestick Patterns That Give The Strongest Reversal Signal.

Some Examples Of Bullish Candles Are The Hammer, Inverted Hammer, And Bullish Engulfing Patterns.

Related Post:

:max_bytes(150000):strip_icc()/AdvancedCandlestickPatterns1-f78d8e7eec924f638fcf49fab1fc90df.png)