Diamond Top Pattern

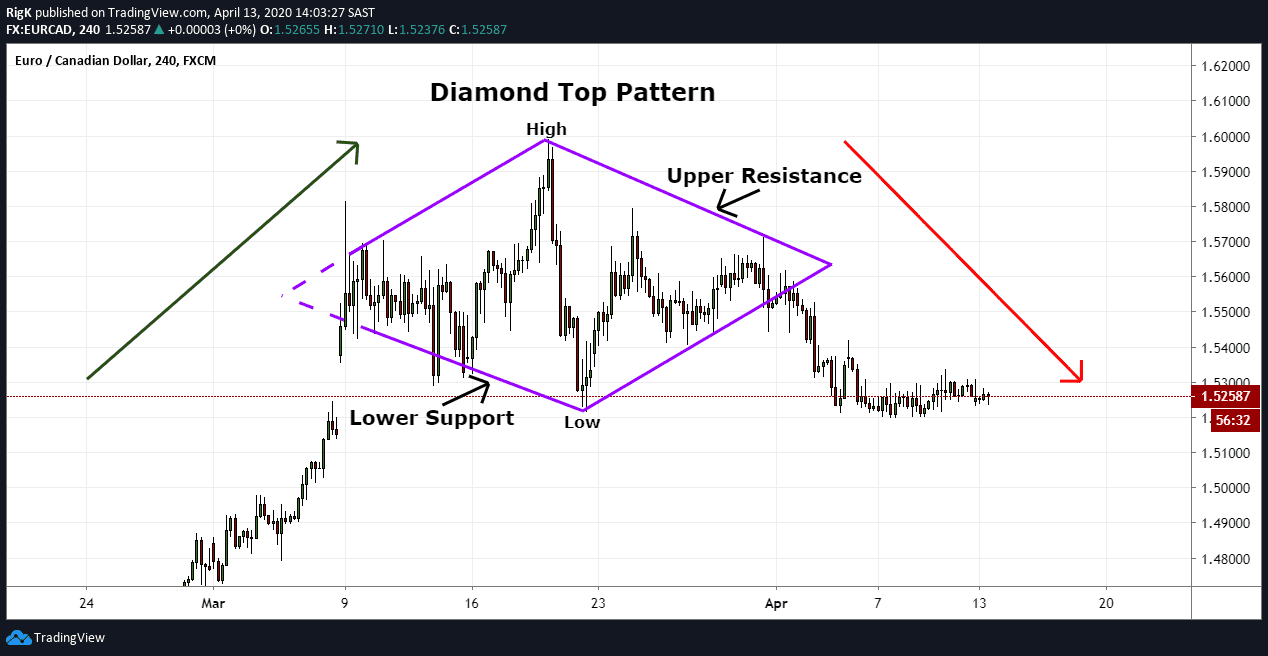

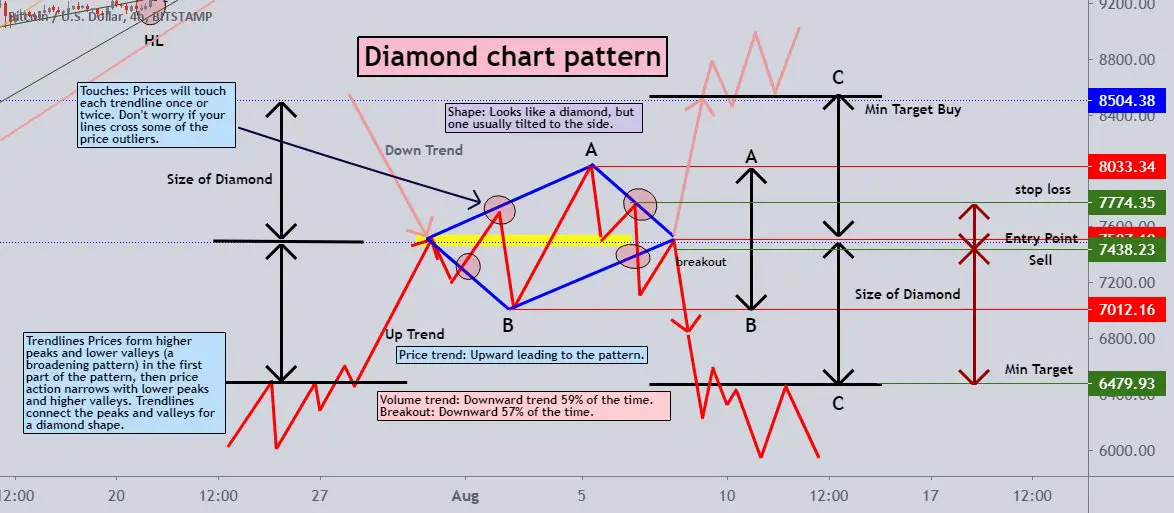

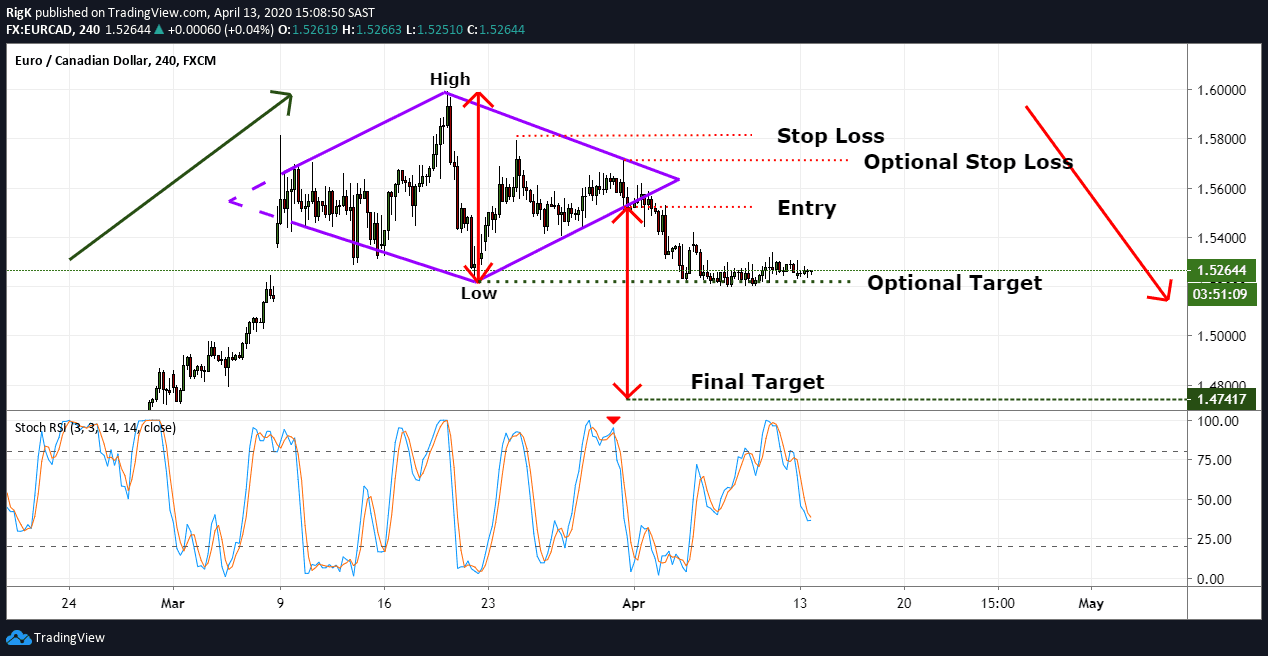

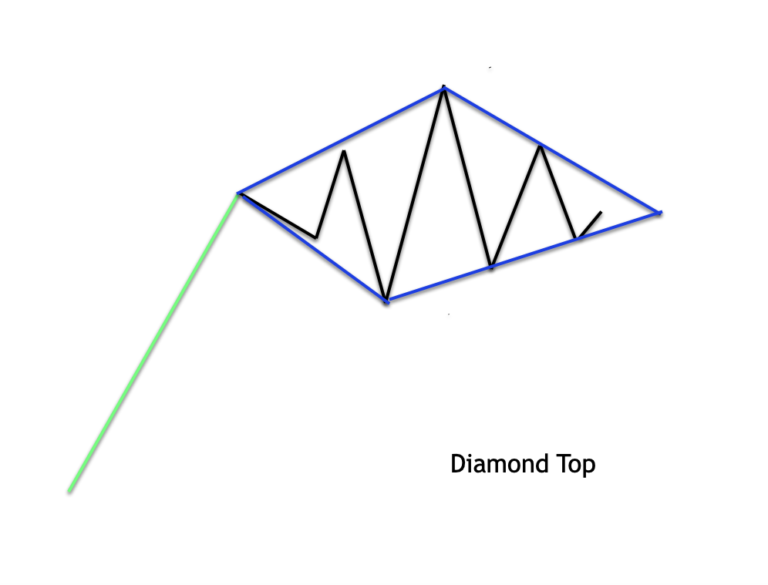

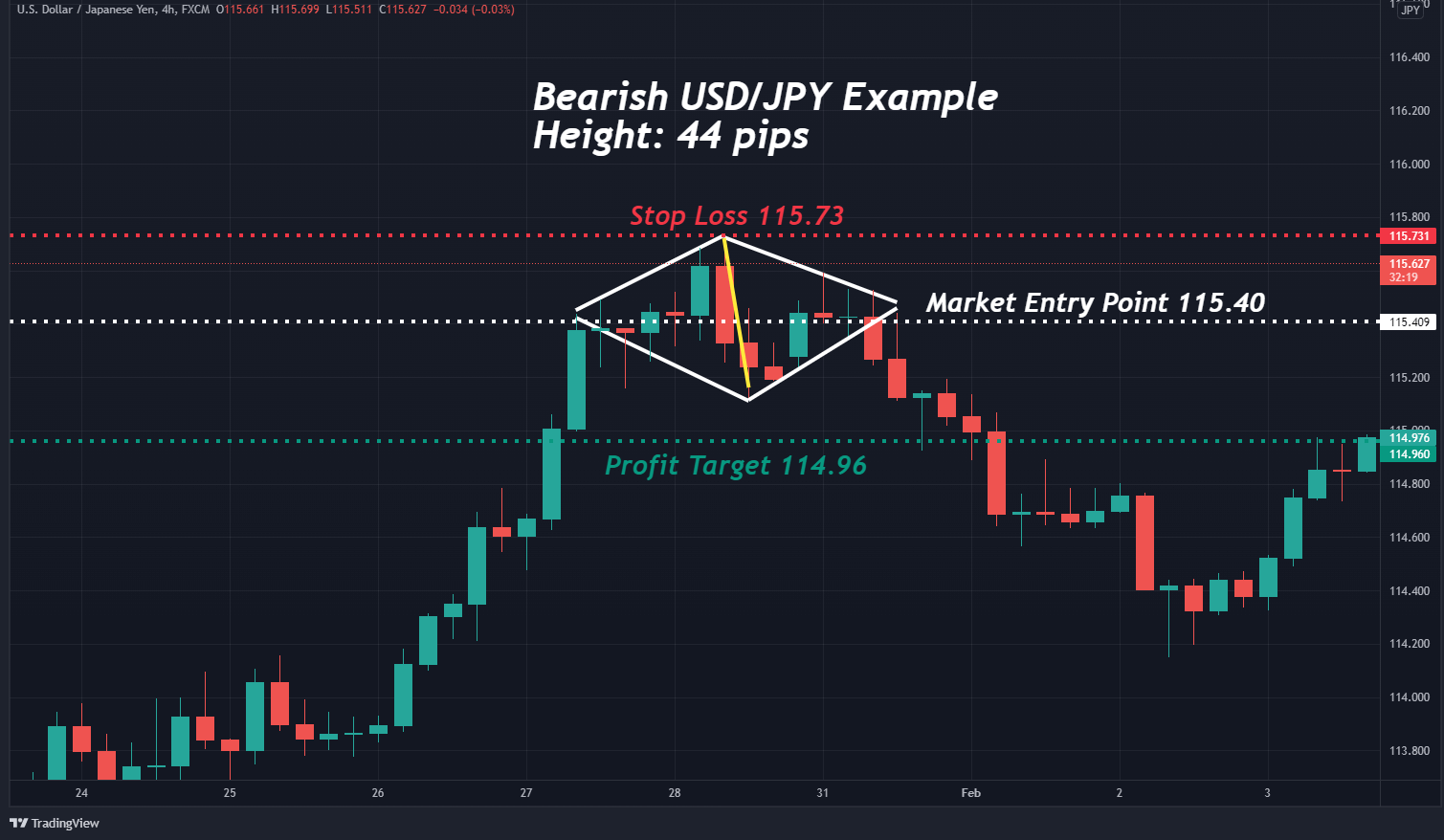

Diamond Top Pattern - A diamond top has to be preceded by a bullish trend. It creates a series of higher highs and lower lows, and then lower highs and higher lows on a price chart. These patterns form on a chart at or near the peaks or valleys of a move, their sharp reversals forming the shape of a diamond. Web statistics updated on 8/26/2020. In this article, we'll explain. Web discover how identifying the diamond top pattern can result in large gains and why you should consider trading it the next time you spot one. Web first, a diamond top pattern happens when the asset price is in a bullish trend. It will also provide practical tips for using them effectively. A diamond top formation is indicative of a potential change in the prevailing trend from bullish to bearish. It is so named because the trendlines. This pattern typically develops after an extended uptrend and is suggestive of buyers losing control, creating potential opportunity for selling assets. It will also provide practical tips for using them effectively. There are 2 types of diamond patterns which are the diamond top pattern and the diamond bottom pattern with diamond tops being a bearish pattern and diamond bottoms being a bullish pattern. The diamond pattern is not seen as often as. It is so named because the trendlines. Web a bullish diamond pattern is often referred to as a diamond bottom, while a bearish diamond pattern is often referred to as a diamond top. Bullish diamond pattern (diamond bottom) bearish diamond pattern (diamond top) Web while a rounded top is fairly intuitive, the diamond pattern merits a definition. A diamond top has to be preceded by a bullish trend. It indicates a period of market consolidation ahead of a. 4/5 (51 reviews) A diamond top formation is indicative of a potential change in the prevailing trend from bullish to bearish. Web a diamond top is a bearish, trend reversal, chart pattern. Second, the price will form what seems like a broadening wedge pattern. Web first, a diamond top pattern happens when the asset price is in a bullish trend. However bullish diamond pattern or diamond bottom is used to detect a reversal following a downtrend. Web here are the rules for trading the diamond top chart pattern: Web the diamond pattern is a reversal indicator that signals the end of a bullish or bearish trend. It looks like a rhombus on the chart. Second, the price will form what. Web a diamond top is a bearish, trend reversal, chart pattern. This article will explore the diamond chart patterns and how they are formed. This shape has two parts: It indicates a period of market consolidation ahead of a. Second, the price will form what seems like a broadening wedge pattern. Web a diamond top is a technical chart pattern that occurs when a security’s price forms a shape resembling a diamond. Initially, there's a phase where prices swing more widely, and after that comes a phase where these swings become less until they're quite narrow. A diamond top has to be preceded by a bullish trend. Web the diamond top. Web first, a diamond top pattern happens when the asset price is in a bullish trend. Second, the price will form what seems like a broadening wedge pattern. A diamond top has to be preceded by a bullish trend. These patterns form on a chart at or near the peaks or valleys of a move, their sharp reversals forming the. There are 2 types of diamond patterns which are the diamond top pattern and the diamond bottom pattern with diamond tops being a bearish pattern and diamond bottoms being a bullish pattern. This pattern typically develops after an extended uptrend and is suggestive of buyers losing control, creating potential opportunity for selling assets. A diamond top is formed by two. The bullish diamond pattern and the bearish diamond pattern. Second, the price will form what seems like a broadening wedge pattern. Web while a rounded top is fairly intuitive, the diamond pattern merits a definition. It is characterized by increasing volatility and oscillations, with the price forming a narrowing range of higher highs and lower lows. Web the diamond top. However, it could easily be mistaken for a head and shoulders pattern. It is so named because the trendlines. Diamond reversal patterns are seen across all different types of financial markets including the stock market, forex market, crypto market, and futures markets. Web while a rounded top is fairly intuitive, the diamond pattern merits a definition. A diamond top is. Web statistics updated on 8/26/2020. This leads to two distinct diamond patterns: Web diamond pattern trading is the strategy traders use to trade these rare trend reversal patterns. Web the diamond top pattern is a bearish reversal pattern, while the diamond bottom pattern is a bullish reversal pattern, providing powerful signals. 4/5 (51 reviews) 4/5 (51 reviews) There are 2 types of diamond patterns which are the diamond top pattern and the diamond bottom pattern with diamond tops being a bearish pattern and diamond bottoms being a bullish pattern. Web a diamond top pattern is a technical analysis pattern that is preceded by a strong uptrend. Web the diamond top pattern happens when prices. Diamond reversal patterns are seen across all different types of financial markets including the stock market, forex market, crypto market, and futures markets. Web a diamond top is a technical chart pattern that occurs when a security’s price forms a shape resembling a diamond. It is characterized by increasing volatility and oscillations, with the price forming a narrowing range of higher highs and lower lows. This particular pattern indicates a potential trend reversal, with a previous uptrend likely to turn into a downtrend. A bottom one, on the other hand, happens when the asset’s price is moving in a bearish trend. Like diamonds bottoms, the top variety (with downward breakouts) can show a fast decline post breakout if a quick rise preceded the diamond reversal. Web a diamond pattern is a chart pattern that is commonly used to identify trend reversals. Web a less talked about but equally useful pattern that occurs in the currency markets is the bearish diamond top formation, commonly known as the diamond top. This leads to two distinct diamond patterns: This pattern typically develops after an extended uptrend and is suggestive of buyers losing control, creating potential opportunity for selling assets. It is most commonly found at the top of uptrends but may also form near the bottom of bearish trends. It is so named because the trendlines. Web symmetrical broadening wedge. Web a diamond top formation is a technical analysis pattern that often occurs at, or near, market tops and can signal a reversal of an uptrend. Web diamond pattern trading is the strategy traders use to trade these rare trend reversal patterns. A diamond pattern is formed on the left side by a series of higher highs and lower lows and, once past the midpoint, a series of lower highs and higher lows.Diamond Top Pattern Definition & Examples (2024 Update)

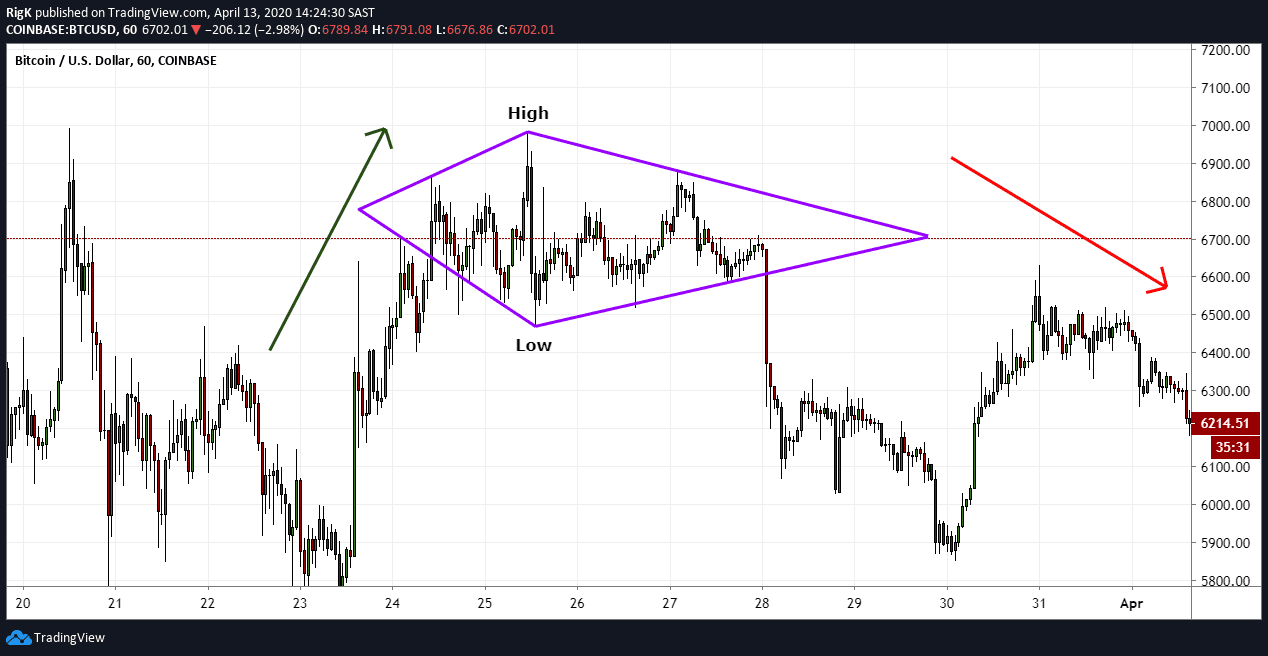

Diamond Top Chart Pattern Stock chart patterns, Trading charts, Forex

What Are Chart Patterns? (Explained)

Diamond Top Chart Pattern

Diamond Top Pattern Definition & Examples (2024 Update)

Diamond Chart Pattern Explained Forex Training Group

Diamond Top Pattern Explained With Examples

Diamond Chart Pattern Explained Forex Training Group

How to Trade the Diamond Chart Pattern (In 3 Easy Steps)

Diamond Top Crochet Pattern Free to download 🧵 CROCHET PATTERNS

Web A Diamond Top Pattern Is A Technical Analysis Pattern That Is Preceded By A Strong Uptrend.

The Diamond Pattern Is Not Seen As Often As.

Web While A Rounded Top Is Fairly Intuitive, The Diamond Pattern Merits A Definition.

Web A Bullish Diamond Pattern Is Often Referred To As A Diamond Bottom, While A Bearish Diamond Pattern Is Often Referred To As A Diamond Top.

Related Post: