Double Bottom Chart Pattern

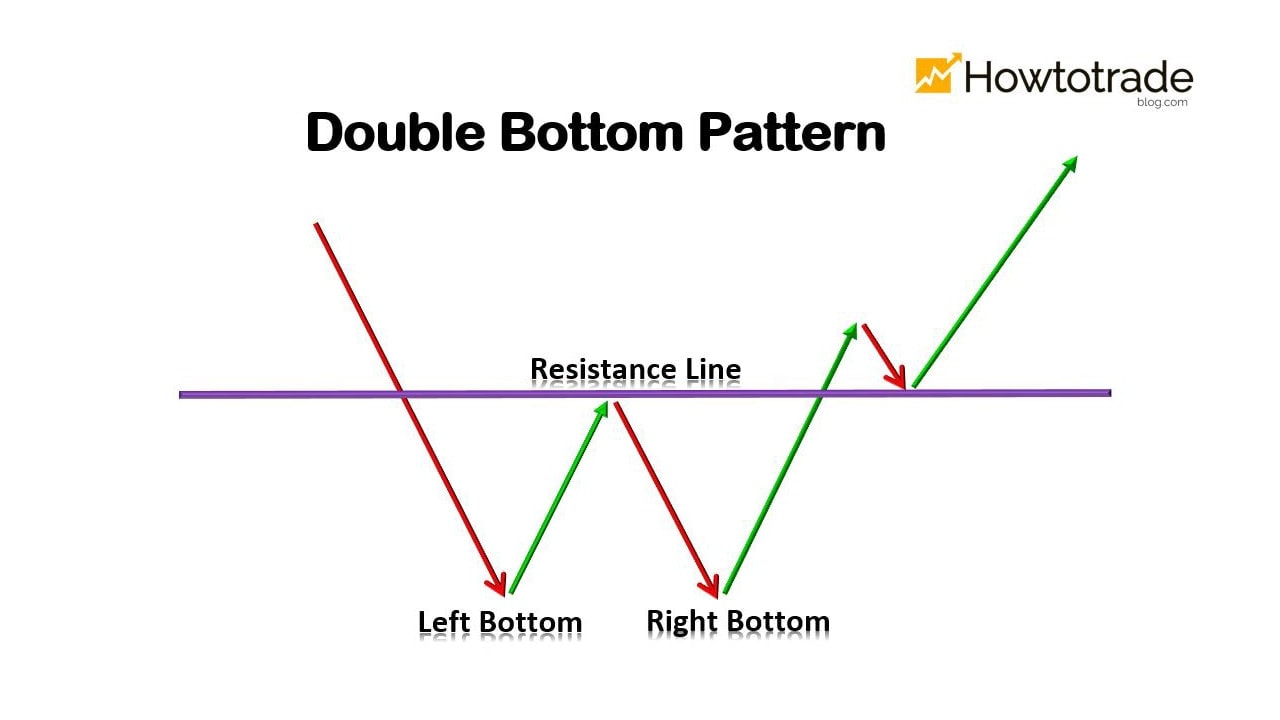

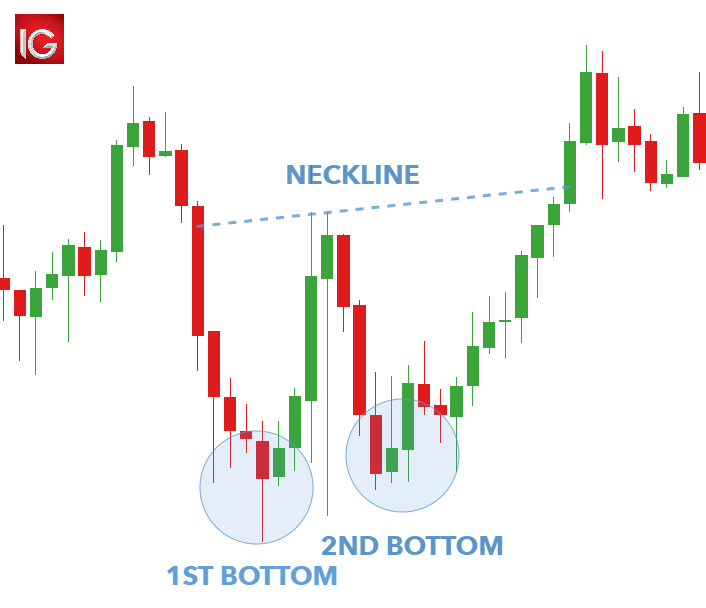

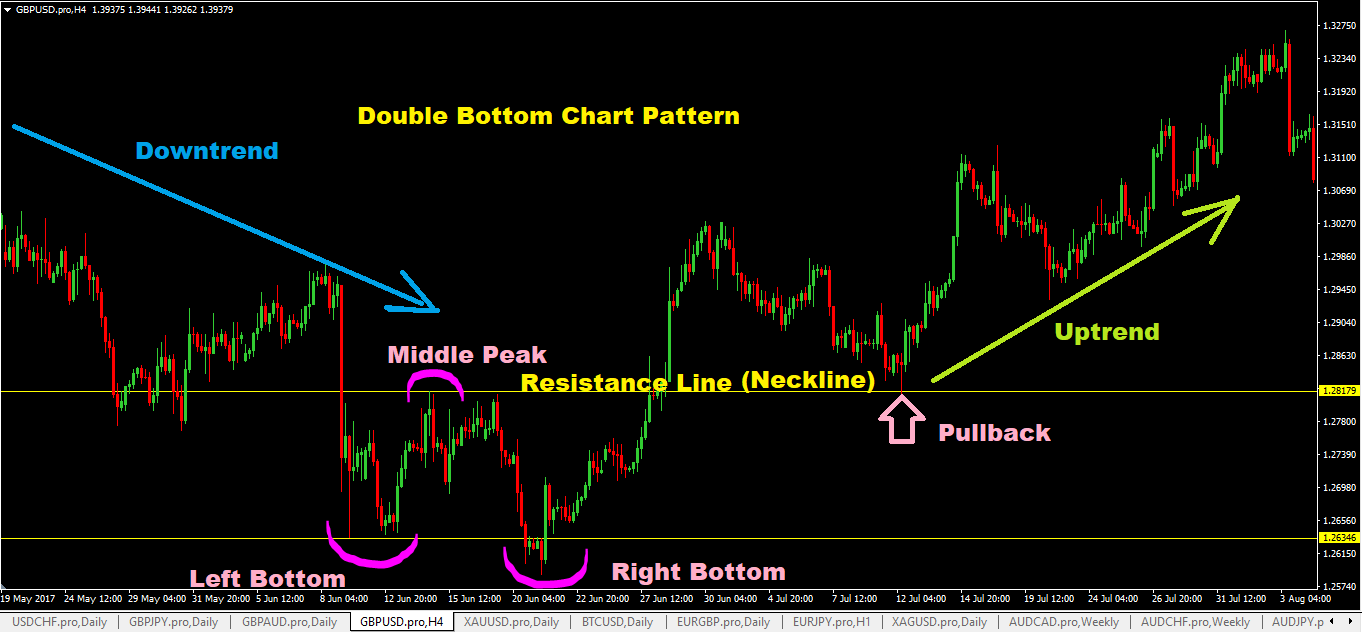

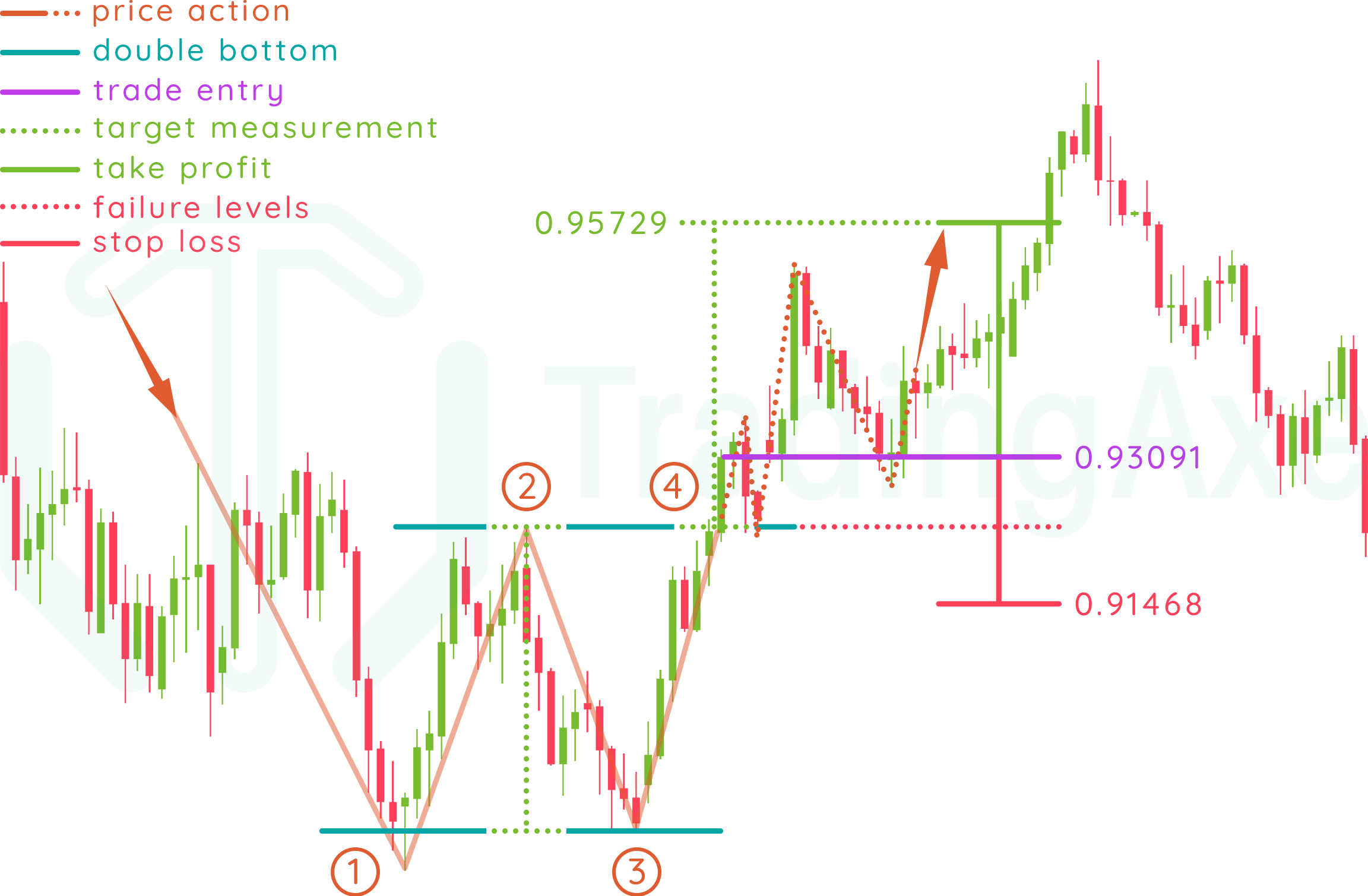

Double Bottom Chart Pattern - Web double top and bottom patterns are chart patterns that occur when the underlying investment moves in a similar pattern to the letter w (double bottom) or m (double top). Web a double bottom is a bullish chart pattern in the shape of a w. Web the double bottom technical analysis charting pattern is a common and highly effective price reversal pattern. Web if you’re interested in finding profitable opportunities with a double bottom pattern, this guide will first explain what a double bottom pattern is, how to identify one, and finally, how to trade a double bottom chart formation. Web the double bottom pattern is a bullish reversal chart pattern that occurs at the end of a downtrend and signals a possible trend reversal. Identify the two distinct bottoms of similar width and height. To create a double bottom pattern, price begins in a downtrend, stops, and then reverses trend. To trade the pattern, you follow three simple steps: Similar to the double top pattern, it consists of two bottom levels near a support line called the neckline. The price successively makes two troughs (lowest points) at approximately the same level, indicating significant support. The price successively makes two troughs (lowest points) at approximately the same level, indicating significant support. Identify the two distinct bottoms of similar width and height. Web double top and bottom patterns are chart patterns that occur when the underlying investment moves in a similar pattern to the letter w (double bottom) or m (double top). But how to identify and trade the double bottom pattern in financial markets trading? To create a double bottom pattern, price begins in a downtrend, stops, and then reverses trend. To trade the pattern, you follow three simple steps: The pattern is seen in a downtrend and may indicate the end of the downtrend, so it is considered a bullish reversal pattern. Web a double bottom is a bullish chart pattern in the shape of a w. Web the double bottom technical analysis charting pattern is a common and highly effective price reversal pattern. Web the double bottom pattern is a trend reversal pattern observed on charts, such as bar and japanese candlestick charts. Web the double bottom technical analysis charting pattern is a common and highly effective price reversal pattern. Similar to the double top pattern, it consists of two bottom levels near a support line called the neckline. The price successively makes two troughs (lowest points) at approximately the same level, indicating significant support. Web the double bottom chart pattern is a. Web double top and bottom patterns are chart patterns that occur when the underlying investment moves in a similar pattern to the letter w (double bottom) or m (double top). Web the double bottom pattern is a trend reversal pattern observed on charts, such as bar and japanese candlestick charts. To trade the pattern, you follow three simple steps: Web. Web the double bottom is one of the easiest chart patterns to trade, which makes it perfect for beginners or anyone who wants to quickly add another profitable set up to their overall trading strategy. Similar to the double top pattern, it consists of two bottom levels near a support line called the neckline. The pattern is seen in a. Web the double bottom technical analysis charting pattern is a common and highly effective price reversal pattern. To create a double bottom pattern, price begins in a downtrend, stops, and then reverses trend. Web the double bottom pattern is a trend reversal pattern observed on charts, such as bar and japanese candlestick charts. Web double top and bottom patterns are. Web the double bottom chart pattern is a price action formation on the chart that consists of two swing lows that end around the same level, and a swing high between them. To trade the pattern, you follow three simple steps: Web if you’re interested in finding profitable opportunities with a double bottom pattern, this guide will first explain what. But how to identify and trade the double bottom pattern in financial markets trading? Web the double bottom chart pattern is a price action formation on the chart that consists of two swing lows that end around the same level, and a swing high between them. Web a double bottom is a bullish chart pattern in the shape of a. Web if you’re interested in finding profitable opportunities with a double bottom pattern, this guide will first explain what a double bottom pattern is, how to identify one, and finally, how to trade a double bottom chart formation. Web a double bottom pattern is a classic technical analysis charting formation that represents a major change in trend and a momentum. The price successively makes two troughs (lowest points) at approximately the same level, indicating significant support. Web if you’re interested in finding profitable opportunities with a double bottom pattern, this guide will first explain what a double bottom pattern is, how to identify one, and finally, how to trade a double bottom chart formation. Web the double bottom chart pattern. To trade the pattern, you follow three simple steps: To create a double bottom pattern, price begins in a downtrend, stops, and then reverses trend. Web the double bottom pattern is a bullish reversal chart pattern that occurs at the end of a downtrend and signals a possible trend reversal. Similar to the double top pattern, it consists of two. Web double top and bottom patterns are chart patterns that occur when the underlying investment moves in a similar pattern to the letter w (double bottom) or m (double top). Identify the two distinct bottoms of similar width and height. To create a double bottom pattern, price begins in a downtrend, stops, and then reverses trend. Web the double bottom. The pattern is seen in a downtrend and may indicate the end of the downtrend, so it is considered a bullish reversal pattern. Web the double bottom technical analysis charting pattern is a common and highly effective price reversal pattern. But how to identify and trade the double bottom pattern in financial markets trading? To trade the pattern, you follow three simple steps: To create a double bottom pattern, price begins in a downtrend, stops, and then reverses trend. Web a double bottom is a bullish chart pattern in the shape of a w. Similar to the double top pattern, it consists of two bottom levels near a support line called the neckline. Web the double bottom pattern is a bullish reversal chart pattern that occurs at the end of a downtrend and signals a possible trend reversal. Web the double bottom chart pattern is a price action formation on the chart that consists of two swing lows that end around the same level, and a swing high between them. Web the double bottom is one of the easiest chart patterns to trade, which makes it perfect for beginners or anyone who wants to quickly add another profitable set up to their overall trading strategy. Web the double bottom pattern is a trend reversal pattern observed on charts, such as bar and japanese candlestick charts. Web a double bottom pattern is a classic technical analysis charting formation that represents a major change in trend and a momentum reversal from a prior down move in market trading.To All The New Members In The AMPSub...Please Continue To Be Humble

Double Bottom Pattern A Trader’s Guide

Double Bottom Pattern New Trader U

Double Bottom Chart Pattern Best Analysis

Forex Double Bottom How To Trade The Double Bottom Chart Pattern Fx

Double Bottom Pattern Rules and Example StockManiacs

DOUBLE BOTTOM CHART PATTERN FREE CHART PATTERN COURSES TECHNICAL

Double Bottom Chart Pattern Forex Trading Strategy

How To Trade Double Bottom Chart Pattern TradingAxe

How To Trade Double Bottom Chart Pattern TradingAxe

Identify The Two Distinct Bottoms Of Similar Width And Height.

Web If You’re Interested In Finding Profitable Opportunities With A Double Bottom Pattern, This Guide Will First Explain What A Double Bottom Pattern Is, How To Identify One, And Finally, How To Trade A Double Bottom Chart Formation.

Web Double Top And Bottom Patterns Are Chart Patterns That Occur When The Underlying Investment Moves In A Similar Pattern To The Letter W (Double Bottom) Or M (Double Top).

The Price Successively Makes Two Troughs (Lowest Points) At Approximately The Same Level, Indicating Significant Support.

Related Post: