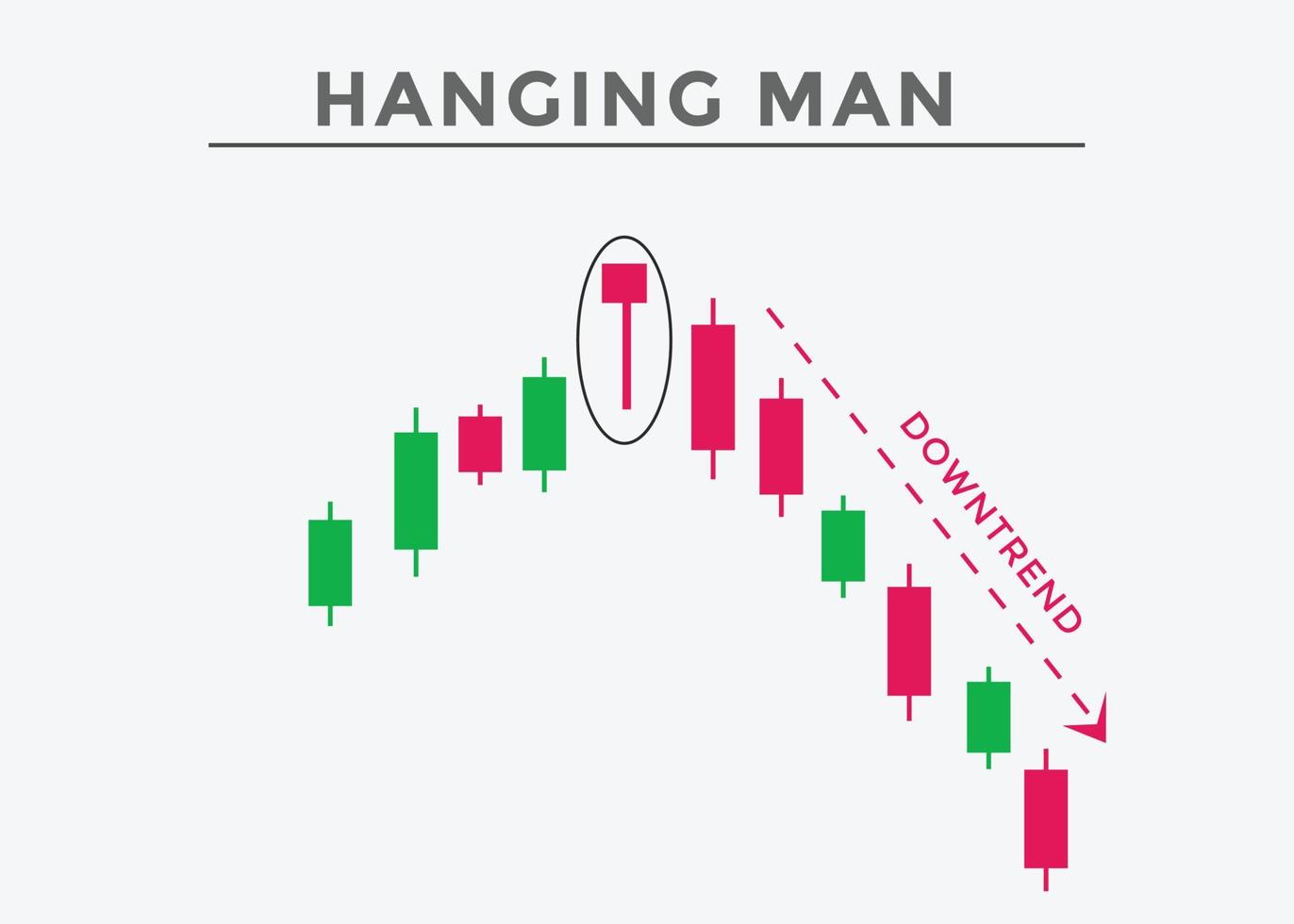

Hanging Man Pattern Candlestick

Hanging Man Pattern Candlestick - While the underlying trend doesn’t need to be bullish for the hanging candlestick to appear, there must be a price rise before the pattern appears and changes the price action direction. Just as you thought it couldn't get anymore crazier. Web 4.4 bearish candlestick patterns. The hanging man is a single candlestick pattern that appears after an uptrend. Web hanging man candlestick pattern in this video i have given all information about hanging man candlestick pattern with live practicle example in pashto langu. A long lower shadow or wick Web hanging man is a pattern that is very popular among analysts similarly as the opposite hammer pattern. Web a hanging man candlestick is a bearish chart pattern used in technical analysis that potentially indicates a market reversal. Web a hanging man candlestick is a technical analysis bearish reversal pattern that indicates a potential trend reversal from an uptrend to a downtrend. It is a reversal pattern characterized by a small body in the upper half of the range, a long downside wick, and little to no upper wick. The hanging man candlestick pattern, as one could predict from the name, is viewed as a bearish reversal pattern. Web a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. The bearish candlestick hammer, also known as the hanging man pattern, occurs when the opening price is higher than the closing price, creating a red candle. In theory, it is supposed to be a bearish reversal but it actually is a bullish continuation pattern 59% of the time. Web the hanging man is a japanese candlestick pattern that technical traders use to identify a potential bearish reversal following a price rise. The hanging man is a single candlestick pattern that appears after an uptrend. It forms at the top of an uptrend and has a small real body, a long lower shadow, and little to no upper shadow. A long lower shadow or wick Web hanging man is a pattern that is very popular among analysts similarly as the opposite hammer pattern. All items below which are previously owned, come buffed and polished to look like new with a 100% money back guarantee less shipping & handling. This man goes by the n. Web hanging man is a bearish reversal candlestick pattern that has a long lower shadow and a small real body. Web a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. Web a hanging man candlestick is a technical analysis bearish. Web hanging man is a bearish reversal candlestick pattern that has a long lower shadow and a small real body. While the underlying trend doesn’t need to be bullish for the hanging candlestick to appear, there must be a price rise before the pattern appears and changes the price action direction. The title/thumbnail is not click bait. Web the bullish. #candlesticks #candlestickpatterns #stockmarket #tradingknowledge #tradingbasics. This pattern is popular amongst traders as it is considered a reliable tool for predicting changes in the trend direction. The candle is formed by a long lower shadow coupled with a small real. This man goes by the n. The hanging man candlestick pattern, as one could predict from the name, is viewed as. Web day 2 of my east coast adventure. Just as you thought it couldn't get anymore crazier. Web a hanging man candlestick is a technical analysis bearish reversal pattern that indicates a potential trend reversal from an uptrend to a downtrend. This pattern occurs mainly at the top of uptrends and can act as a warning of a potential reversal. Web the hanging man candlestick is a popular one, but one that shows lousy performance. Web in technical analysis, the hanging man patterns are a single candlestick patterns that forms primarily at the top of an uptrend. The title/thumbnail is not click bait. Beyond technical expertise and safety considerations, our chandelier installation experts can also offer valuable design insights. Specifically,. Web the hanging man is a notable candlestick pattern in trading, signaling a possible shift from bullish to bearish market trends. The bearish candlestick hammer, also known as the hanging man pattern, occurs when the opening price is higher than the closing price, creating a red candle. Web the hanging man candlestick pattern is a bearish reversal that forms in. This man goes by the n. Web a hanging man is a bearish reversal candlestick pattern that takes place at the top of a bullish uptrend. Web a hanging man candlestick is a bearish chart pattern used in technical analysis that potentially indicates a market reversal. Hanging man pattern perfect accuracy in trading #trading #tradingreel #hangingman #candlestick. If the candlestick. Web hanging man is a bearish reversal candlestick pattern that has a long lower shadow and a small real body. Web the hanging man candlestick pattern is characterized by a short wick (or no wick) on top of small body (the candlestick), with a long shadow underneath. What does hanging man pattern indicate. Web the hanging man is a notable. It has the appearance of the hammer pattern — small body and long lower shadow — but unlike the latter, the hanging man is. We understand the importance of aesthetics and take into account the overall ambiance of the room as well as its design features. What does hanging man pattern indicate. Gorham chantilly list of in stock items. Web. Web a hanging man is a bearish reversal candlestick pattern that takes place at the top of a bullish uptrend. All one needs to do is find a market entry point, set a stop loss, and locate a profit target. Web a hanging man candlestick is a technical analysis bearish reversal pattern that indicates a potential trend reversal from an. Bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. It has the appearance of the hammer pattern — small body and long lower shadow — but unlike the latter, the hanging man is. Web a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. The bearish candlestick hammer, also known as the hanging man pattern, occurs when the opening price is higher than the closing price, creating a red candle. This candlestick pattern appears at the end of the uptrend indicating weakness in further price movement. Beyond technical expertise and safety considerations, our chandelier installation experts can also offer valuable design insights. Web the bullish candlestick pattern is formed when the closing price is higher than the opening price, indicating that the bulls overpowered the bears before market close. This pattern is popular amongst traders as it is considered a reliable tool for predicting changes in the trend direction. The candle is formed by a long lower shadow coupled with a small real. Specifically, the hanging man candle has: Web the hanging man candlestick pattern is a bearish reversal that forms in an upward price swing. All items designated as factory brand new are first quality fresh from the factory! Perhaps this is a consequence of the impressive name referring to the shape of the candle resembling a hanged man. The real body of the candle is smaller with a long shadow. Web the hanging man candlestick pattern is characterized by a short wick (or no wick) on top of small body (the candlestick), with a long shadow underneath. Web 4.4 bearish candlestick patterns.Hanging Man Candlestick Pattern Trading Strategy

Hanging Man' Candlestick Pattern Explained

Hanging man candlestick chart pattern. Trading signal Japanese

Hanging Man Candlestick Pattern Trading Strategy

Hanging Man Candlestick Patterns Complete guide [ AZ ] YouTube

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

How to Trade the Hanging Man Candlestick ForexBoat Trading Academy

Hanging Man Candlestick Pattern (How to Trade and Examples)

How to Identify Perfect Hanging Man Hanging Man Candlestick Pattern

Web In Technical Analysis, The Hanging Man Patterns Are A Single Candlestick Patterns That Forms Primarily At The Top Of An Uptrend.

This Pattern Occurs Mainly At The Top Of Uptrends And Can Act As A Warning Of A Potential Reversal Downward.

Web What Is A Hanging Man Candlestick Pattern?

All One Needs To Do Is Find A Market Entry Point, Set A Stop Loss, And Locate A Profit Target.

Related Post:

:max_bytes(150000):strip_icc()/UnderstandingtheHangingManCandlestickPattern1-bcd8e15ed4d2423993f321ee99ec0152.png)

![Hanging Man Candlestick Patterns Complete guide [ AZ ] YouTube](https://i.ytimg.com/vi/IgS8pO3g71U/maxresdefault.jpg)