Tweezer Tops Pattern

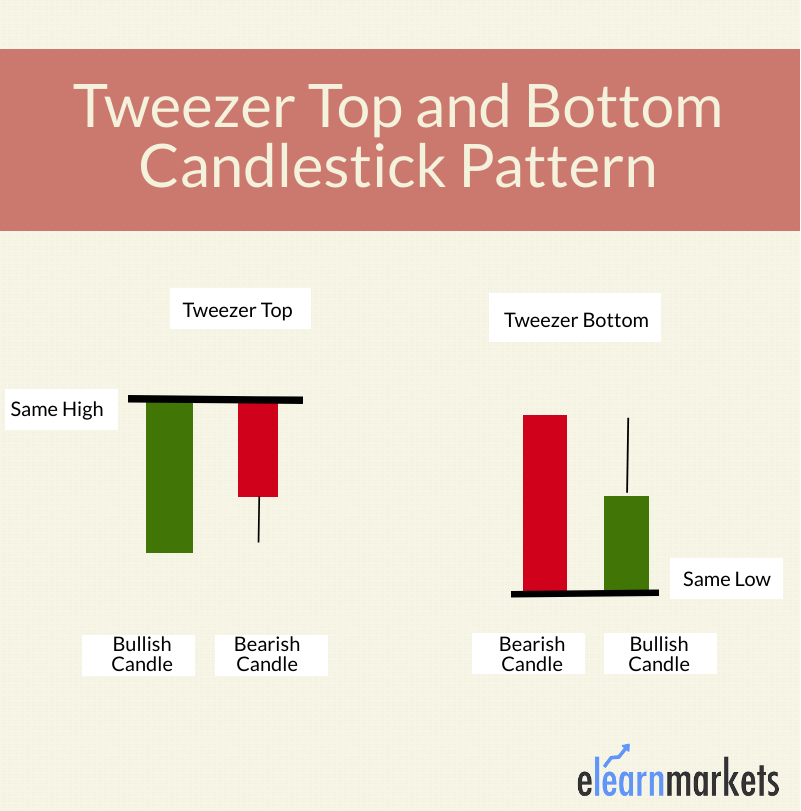

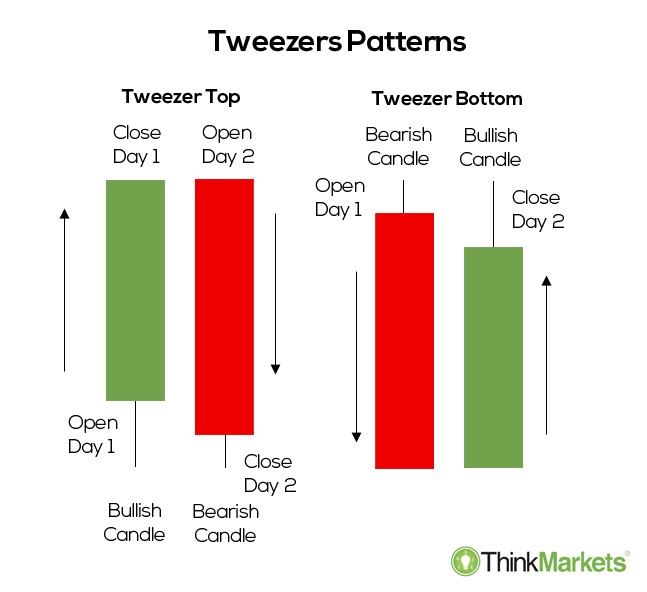

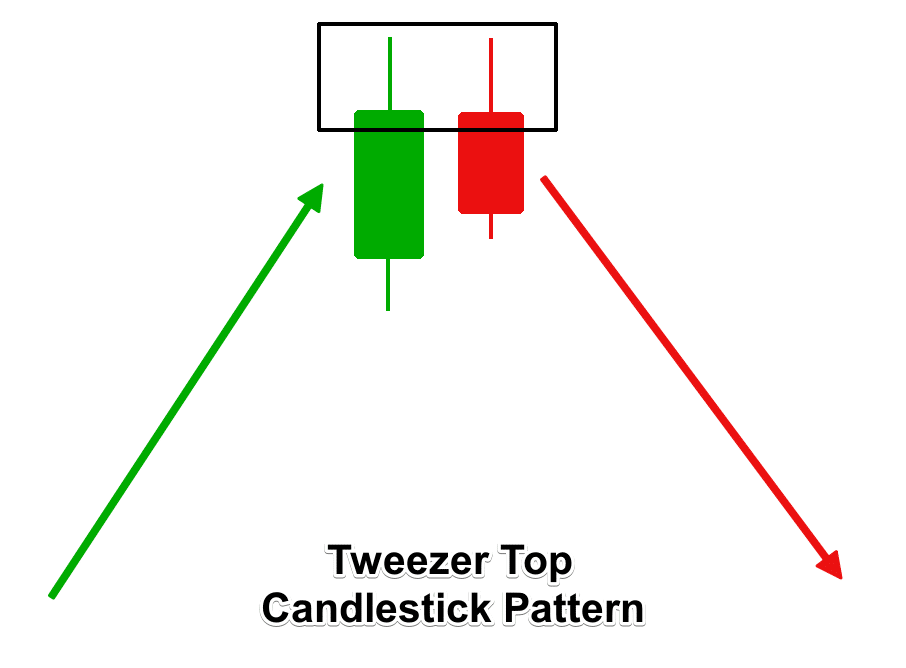

Tweezer Tops Pattern - 2] cut out your fabric pieces, as well as 3 long bias strips. The matching tops are usually composed of shadows (or wicks) but can be the candle’s bodies as well. This pattern can form at turning points in the market near support levels, signaling a bearish reversal. Web tweezer tops and bottoms are revered candlestick patterns that help traders discern potential price reversals in the market. In this article, we will delve into the details of these patterns, understand their formation, and explore their application in trading strategies. Web tweezer top and bottom, also known as tweezers, are reversal candlestick patterns that signal a potential change in the price direction. The tweezers top patterns are bearish, and the tweezers bottom are bullish. Usually, it appears after a price move to the upside and shows rejection from higher prices. Third, those candles must reach the same high point. To identify this bearish candlestick pattern, you’ll need to spot the following (very flexible) criteria: It’s a bearish reversal pattern. Trading the tweezer top is simple. Web a tweezer is a technical analysis pattern, commonly involving two candlesticks, that can signify either a market top or bottom. 1] print and cut out templates. Web tweezer top candlestick pattern. Web what is a tweezer top candlestick? Third, those candles must reach the same high point. Web this wrap crop top pattern will fit a u.s. Web what is the tweezer top pattern? Web the tweezer pattern is a double candlestick pattern that should appear in an existing trend. It consists of two candles, where the first is bullish, followed by a bearish or bullish candle with the same high as the previous bar. Both formations consist of two candles that occur at the end of a trend, which is in its dying stages. 1] print and cut out templates. Usually, it appears after a price move to the. Web the tweezer top is a japanese candlestick pattern. Both formations consist of two candles that occur at the end of a trend, which is in its dying stages. In this article, we will delve into the details of these patterns, understand their formation, and explore their application in trading strategies. Here's the list of some of the best wrap. Both formations consist of two candles that occur at the end of a trend, which is in its dying stages. Both formations consist of two candles that occur at the end of a trend, which is in its dying stages. Web a tweezer is a technical analysis pattern, commonly involving two candlesticks, that can signify either a market top or. Web what is the tweezer top pattern? Web the tweezer top is a bearish reversal candlestick pattern that occurs after an uptrend. Web tweezer top and bottom, also known as tweezers, are reversal candlestick patterns that signal a potential change in the price direction. It is classified as a bearish reversal chart pattern. Web a tweezer top is a bearish. Web this wrap crop top pattern will fit a u.s. Web tweezer top and bottom, also known as tweezers, are reversal candlestick patterns that signal a potential change in the price direction. Web want to spruce up the feel of your wardrobe? To execute a trade, place a sell order beneath the second candle, a stop loss above the pattern’s. Unlike the bullish tweezer bottom, the tweezer top formation’s first candlestick shows a potential bullish trend that tops out without a wick. In terms of location, there are two types of tweezers: The pattern is bearish because we expect to have a bear move after the tweezer top appears at the right location. My free wrap crop top pattern (includes. Web july 12, 2024 / 4:08 pm edt / cbs news. A tweezer top pattern forms when two or more consecutive candlesticks have the same high price,. This wrap shirt pattern is perfect for all your summer time activities. First, there must be two or more adjacent candles of either color. My free wrap crop top pattern (includes sewing allowance,. I hope they are of value to you. Here's the list of some of the best wrap top sewing projects and patterns that i could find on the internet. Demonstrate the ability to load rubidium atoms into an optical lattice placed in an optical cavity. 2] cut out your fabric pieces, as well as 3 long bias strips. Usually, it. With the aid of optical tweezers and individual site addressability, they were able to load the lattice deterministically and entangle specific atoms with photons. A tweezers top is when two candles occur back to back with very similar highs. In this article, we will delve into the details of these patterns, understand their formation, and explore their application in trading. The tweezer top pattern is a bearish reversal candlestick pattern that is formed at the end of an uptrend. Web this wrap crop top pattern will fit a u.s. Trading the tweezer top is simple. It occurs during an uptrend when buyers attempt to push prices higher but cannot do so, frequently ending the session near the session tops. A. Web tweezer top and bottom, also known as tweezers, are reversal candlestick patterns that signal a potential change in the price direction. Demonstrate the ability to load rubidium atoms into an optical lattice placed in an optical cavity. It is classified as a bearish reversal chart pattern. Usually, it appears after a price move to the upside and shows rejection from higher prices. Web among the various candlestick patterns, the tweezer top and bottom patterns hold significance due to their ability to signal possible trend reversals. Unlike the bullish tweezer bottom, the tweezer top formation’s first candlestick shows a potential bullish trend that tops out without a wick. First, there must be two or more adjacent candles of either color. My free wrap crop top pattern (includes sewing allowance, print at 100%) men’s large shirt / 1 yard of fabric. Web this wrap crop top pattern will fit a u.s. Web the tweezer top is a japanese candlestick pattern. Web what is the tweezer top pattern? No worries, as we are wrap top patterns to serve! A tweezers top is when two candles occur back to back with very similar highs. Trend traders can find a tweezer. Third, those candles must reach the same high point. I hope they are of value to you.What are Top & Bottom Tweezer Candlestick Explained ELM

How To Trade The Tweezer Top Chart Pattern (In 3 Easy Steps)

How To Trade The Tweezer Top Chart Pattern (In 3 Easy Steps)

Tweezer Top Pattern Definition, its Significance, and Technical Analysis

Candlestick Cheat Sheet for Forex Traders ForexBoat Trading Academy

What Are Tweezer Tops & Tweezer Bottoms? Meaning And How To Trade

Tweezer Top Pattern Definition, its Significance, and Technical Analysis

What Are Tweezer Tops & Tweezer Bottoms? Meaning And How To Trade

What Are Tweezer Tops & Tweezer Bottoms? Meaning And How To Trade

Candlestick Patterns The Definitive Guide (2021)

This Pattern Can Form At Turning Points In The Market Near Support Levels, Signaling A Bearish Reversal.

That’s All There Is To It!

To Execute A Trade, Place A Sell Order Beneath The Second Candle, A Stop Loss Above The Pattern’s High, And A Profit Target Under The Entry Point.

It Consists Of Two Candles, Where The First Is Bullish, Followed By A Bearish Or Bullish Candle With The Same High As The Previous Bar.

Related Post: